Picture the world around you in five years’ time. As you go about your routines in 2028 – working, shopping, holidaying – what will be different to today? Instinctively, you might assume that not much will vary; after all, how much can really change in the span of five years? Now transport yourself back to 2018 and entertain the same question. Could you have foreseen today’s widespread adoption of hybrid working, or the sweeping supply chain disruptions steered by global politics?

Our world is constantly evolving, sometimes at such breakneck speed that we only grasp it once it’s already behind us. Being able to understand and integrate these long-term changes into investment portfolios is a challenge. This is where thematic investing fits in – as a means of seeking to harness emerging innovations that drive productivity, while seeking to limit the pitfalls of capitalism’s creative destruction.

Thematic investing focuses on picking companies potentially set to capitalise on future trends and macroeconomic themes, often related to technology, demography and environmental challenges.

Technological themes include digitalisation, automation and robotics, artificial intelligence (AI), social media, blockchain, and cloud computing. Demographic trends focus on the challenges of growing and ageing populations, lifestyle, wealth increases, medical progress, and generational spending patterns. Changes relating to environmental trends focus on climate change, renewables, waste management, agribusiness, and water. Infrastructure and urbanisation are also relevant.

A number of thematic ETFs are available to UK investors. These instruments track indices designed to be forward-looking, in that they focus on companies which potentially play a role in the themes of tomorrow. As opposed to traditional ETFs, which mostly adhere to market capitalisation-based weighting, thematic ETFs may track indices weighted in a different manner. A typical thematic index might, for example, only include stocks that generate revenues above a specific threshold from certain sectors linked to the theme in question. These stocks are usually weighted not only by market capitalisation but also by their relevance for the particular theme – therefore providing a balance between owning larger stocks which are important to the theme but which also conduct other activities, and owning smaller, pure-play stocks which are more focused on the theme but are a smaller part of the market.

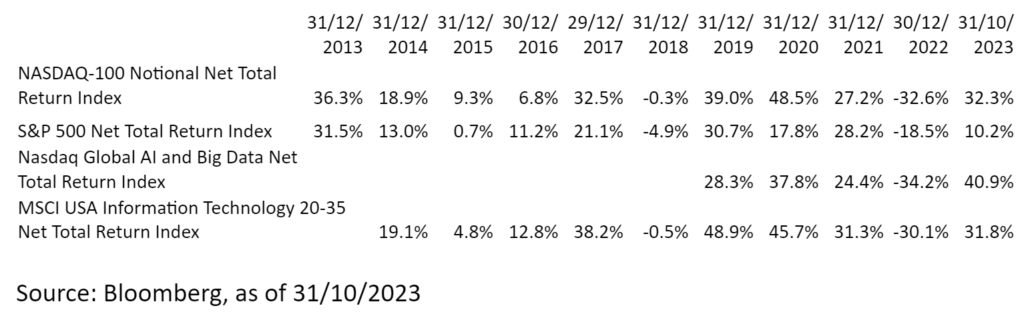

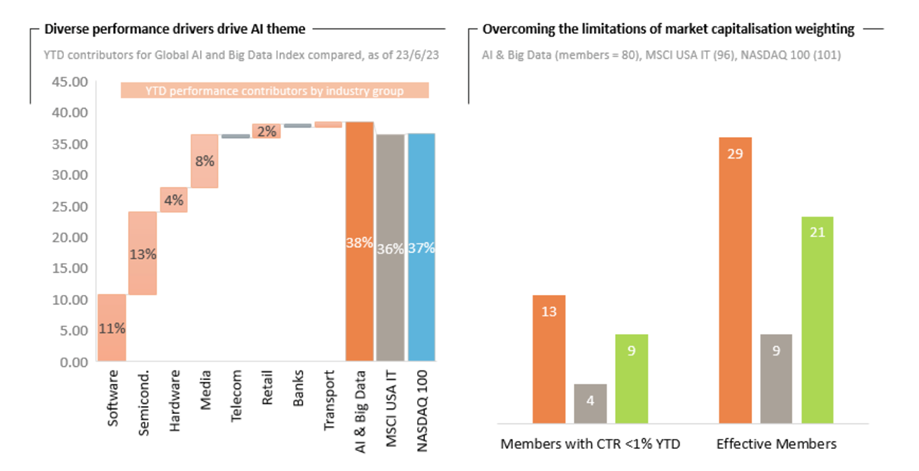

The performance of the major traditional indices can easily mask the impact of underlying thematic trends. This year there has been significant focus on how much of the performance of well-known indices like the S&P 500 has been driven by mega-cap technology stocks. But we should also bear in mind that it is not the size of these companies alone that has driven their performance. It is also their alignment with the AI theme which has driven markets more broadly in 2023.

So it is important to differentiate between the performance of large-cap-weighted indices with that of specialised thematic indices, even if they seem similar on the surface. Thematic ETFs can be a useful way to diversify and reduce concentration to the largest stocks in the market.

A good example of this is the performance of the Nasdaq Global Artificial Intelligence and Big Data Index. While its year-to-date performance rivals that of technology indices like the Nasdaq 100 and the MSCI USA Information Technology Index, the contributors to its performance are very different: its performance contribution was split across a broader range of stocks, beyond the seven largest tech firms that propelled many market capitalisation weighted indices in this space. The index also successfully captured performance generated across the value chain, with return drivers spread across software, semiconductors and media.

Case Study: Global AI and Big Data Index

Passive index construction in practice – ‘rising tide’ in AI lifts stocks across the thematic value chain.

There could, therefore, be benefits to taking a more granular approach and looking beyond core allocations. Investors wishing to take such an approach will have to decide what role innovation should play in their portfolio, and more specifically what exposure they wish to have to selected mega-caps.

Assessing the role that innovation should play in a portfolio

Amara’s Law states that we tend to overestimate the impact of technological innovations in the short term and underestimate their impact in the long term. This naturally means new technological innovations come with a certain level of inherent volatility, from an investor’s point of view, as they move through the cycle from nascent, to being potentially over-hyped, and then eventually to maturity. The lesson is that they require a longer horizon when investing.

While AI currently gets the most attention within the field of thematics, the opportunity set is far broader. A prime example is healthcare, which has performed strongly in recent years. Even here, however, further differentiation can be made. Taking a closer look at underlying performance drivers reveals that certain key technologies, such as mRNA research, have been particularly influential. This technology has not only enabled the development of Covid vaccines, but also a wide range of potential applications beyond the pandemic.

Moreover, investors have sought exposure to some of the leading research companies in genomics – the science of sequencing the human genome, editing it and developing gene-based therapies. If successful, these techniques have the potential to transform healthcare.

This is just one way in which thematic products can be used to isolate more specific themes than the broad ‘healthcare’ sector, thereby shaping a portfolio to be more in line with the views one wishes to express.

What all these solutions have in common is that they span sectors and countries and are linked by theme rather than geography or traditional business area.

Assessing exposure to mega-caps

The success of ETF investing, and thematic investing in particular, has always been based on broad diversification and the management of concentration and idiosyncratic risks. The renewed hype around AI stocks has resulted in market-cap weighted indices becoming more concentrated, as they are dominated by a small number of very large tech stocks. Even the S&P 500, typically considered a broad measure of the US equity market, is now dominated by its top 10 stocks, which account for 30% of market value. Similarly, the S&P 500’s IT sector is now the most dominant sector, also accounting for approximately 30%.

Thematic portfolio construction, typically capping single names below five percent and weighting by thematic relevance, can be a useful way to manage diversification when blended with market-cap-weighted indices.

And while the hype around AI has been a key theme this year, it is worth recognising there are only a small number of very experienced companies developing and deploying AI models in their product suite on a profitable basis. The majority of companies are just getting started with AI, and potential future AI winners may not even be established yet. This makes the case for a flexible and open investment methodology, one that looks beyond past winners and is programmed to be forward looking.

Overall, this year’s performance trends are a good reminder of the role that thematic investing can play in an investor’s portfolio. Balanced portfolio construction can help avoid excessive single name risks while providing access to some of the most significant growth themes of the present and future. And although growth investing is always associated with higher volatility, aligning portfolios with structural growth cases and giving them sufficient time to develop their full potential may be a rewarding strategy that can help to uncover the megacaps of tomorrow.

Important information

Reviewed and reissued by InvestEngine (UK) Limited which is Authorised and Regulated by the Financial Conduct Authority.

Created and issued in the UK by DWS Investments UK Limited. DWS Investments UK Limited is authorised and regulated by the Financial Conduct Authority.

CRC 1758

PAST PERFORMANCE DOES NOT PREDICT FUTURE RETURNS

This document is intended as marketing communication. This document has been prepared without consideration of the investment needs, objectives or financial circumstances of any investor. Without limitation, this document does not constitute an offer, an invitation to offer or a recommendation to enter into any transaction.

Investments are subject to various risks, including market fluctuations, regulatory change, counterparty risk, possible delays in repayment and loss of income and principal invested. The value of investments can fall as well as rise and you may not recover the amount originally invested at any point in time. Furthermore, substantial fluctuations of the value of the investment are possible even over short periods of time.

Before making an investment decision, investors need to consider, with or without the assistance of an investment adviser, whether the investments and strategies described or provided by DWS are appropriate in light of their particular investment needs, objectives and financial circumstances. Information in this document has been obtained or derived from sources believed to be reliable and current. However, accuracy or completeness of the sources cannot be guaranteed.

Investors should refer to the Risk Factors in the prospectus and Key Investor Information Document (KIID). For general information regarding the nature and risks of the proposed transaction and types of financial instruments please go to https://etf.dws.com/en-gb/risks-and-terms/etf-risk-factors/

Any investment decision in relation to a fund should be based solely on the latest version of the prospectus, the audited annual and, if more recent, un-audited semi-annual reports and the Key Investor Information Document (KIID), all of which are available in English upon request to DWS Investment S.A., 2, Boulevard Konrad Adenauer, L-1115 Luxembourg or on www.Xtrackers.com

Xtrackers is an undertaking for collective investment in transferable securities (UCITS) in accordance with the applicable laws and regulations and set up as open-ended investment company with variable capital and segregated liability amongst its respective compartments.

DWS Investment S.A. acts as the management company of Xtrackers, Xtrackers II and Xtrackers (IE) plc.