Benjamin Franklin once said, “The bitterness of poor quality remains long after the sweetness of low price is forgotten”. Nowhere is this truer than in the realm of investing. The long-term stability of a portfolio often hinges on the quality of its holdings.

In this blog, we look at why including high-quality, dividend growing companies in investment portfolios should be a key consideration. From their typically unwavering stability, to their ability to generate returns, grow their dividend and lower most risks, high-quality companies offer an exciting recipe for success.

Generating returns over the long term

High-quality and dividend growing companies typically offer significant upside capture potential. These companies often possess strong management teams focused on innovation, efficiency, and long-term value creation. They invest in research and development, expanding their product/service offerings and staying ahead of industry trends.

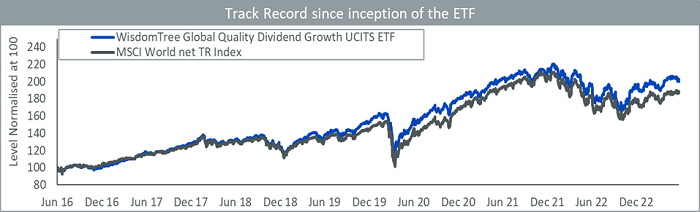

High-quality companies have a track record of generating above-average revenue and earnings growth. By including such highly profitable companies in an equity portfolio, investors can benefit from their ability to outperform the broader market over time, as demonstrated by academics over the last six decades. As highlighted in Figure 1, the WisdomTree Global Quality Dividend Growth UCITS ETF has outperformed the market by 1.1% on average per year since its launch seven years ago, after fees. This highlights the potential for outperformance of a strategy focused on high-quality, dividend growing companies.

Figure 1: The WisdomTree Global Quality Dividend Growth UCITS ETF outperformed since launch by more than 1% per annum net of fees

Source: WisdomTree, Bloomberg. Period from 07 June 2016 to 31 May 2023. Calculations are based on daily NAV in USD. The inception date for the WisdomTree Global Quality Dividend Growth UCITS ETF is 07 June 2016. Performances over periods longer than a year are annualised. You cannot invest directly in an index.

Historical performance is not an indication of future performance, and any investments may go down in value.

Dividend Growth

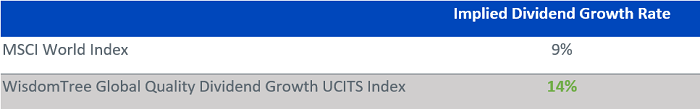

Investors also value high-quality companies for their ability to generate growing cash flow and, in many cases, growing dividends. High-quality companies often have a history of delivering stable and growing earnings and then allocate a portion of their profits to regular dividend payments, which provide a steady income stream for investors. The most profitable companies, by generating more and more cash flows, have the capacity to pay increasingly high dividends. This is demonstrated below in Figure 2. The WisdomTree Global Quality Dividend Growth UCITS ETF exhibits an Implied Dividend Growth Rate of 14% versus only 9% for the MSCI World, thanks to an elevated Return on Equity.

Figure 2: Higher Implied Dividend Growth for WisdomTree Global Quality Dividend Growth Index

Source: WisdomTree, FactSet. As of end of May 2023. The implied Dividend growth rate is classically calculated as the multiplication of the Return on Equity by the Retention ratio.

Historical performance is not an indication of future performance and any investments may go down in value.

Stability and resilience

High-quality companies are known for their historical stability and resilience, even amid market volatility and economic downturns. These companies tend to have high profitability, strong balance sheets, low debt levels and robust cash flows. As a result, they are better equipped to weather challenging economic conditions. In uncertain times, investors often seek the relative safety of these companies, which can provide stability to a portfolio.

Furthermore, high-quality companies tend to have established market positions and well-known brands. This enables them to maintain a competitive advantage over their peers and sustain market share, even during periods of intense competition. The ability to adapt to changing market dynamics and generate consistent revenues helps these companies navigate through economic cycles, providing stability and reducing investment risk.

This, in turn, translates into a unique ‘all-weatherness’ for quality-focused investment strategies. To demonstrate this capacity of high-quality companies to outperform in most market scenarios, we consider all the strategies (mutual funds and exchange-traded funds (ETFs), active and passive) in the two Morningstar Peer Groups ‘Global Large Cap Blend’ and ‘Global Equity Income’ and try to assess how consistent they have been in outperforming the market. To do so, for each strategy, we calculate the number of 12 month periods where the strategy outperformed the market after fees and the number of periods where it did not. We then compare the results to the same calculations for the WisdomTree Global Quality Dividend Growth UCITS ETF.

+ Our ETF outperformed the market in 76% of the 12 month periods since its launch in 2016.

+ We observe that, out of the 1118 strategies that have at least as long a track record as our ETF (that is, a launch date before 7 June 2016) and that have a tracking error of at least 0.75% to the market (that is, they are not trackers of MSCI World), only five strategies have managed to outperform more often (that is, to be as consistent).

+ So, 1113 strategies had less consistent returns than our Quality Dividend Growth ETFs, and five were more consistent.

Figure 3: Distribution of strategies depending on the proportion of 12 month periods in which they outperformed the market

Source: WisdomTree, Morningstar. Period from 30 June 2016 to 31 May 2023. Calculations are based on monthly NAV in USD. 2 peer groups are used: Global Income and Global Large Cap Blend. Performances over periods longer than a year are annualised. You cannot invest directly in an index.

Historical performance is not an indication of future performance, and any investments may go down in value.

Risk mitigation and portfolio diversification

Considering high-quality, dividend-growing companies in an equity portfolio could help mitigate risk and enhance diversification. These companies often exhibit lower volatility compared to their riskier counterparts, however the potential for dividend cuts or elimination is always present.

This is the case for the WisdomTree Global Quality Dividend Growth UCITS ETF, which outperformed since launch with a volatility of only 15%, that is, 1.3% less than the market.

Figure 4: The WisdomTree Global Quality Dividend Growth UCITS ETF outperformed with less volatility than the market

Source: WisdomTree, Bloomberg. Period from 07 June 2016 to 31 May 2023. Calculations are based on daily NAV in USD. The inception date for the WisdomTree Global Quality Dividend Growth UCITS ETF is 07 June 2016. Performances over periods longer than a year are annualised. You cannot invest directly in an index.

Historical performance is not an indication of future performance and any investments may go down in value.

By considering diversifying across high-quality companies operating in different industries and geographies, investors can look to spread risk and avoid overexposure to any single company or sector. This diversification provides a level of protection against idiosyncratic risks associated with individual companies or sectors, thereby safeguarding the overall portfolio.

Conclusion

In summary, high-quality companies are a fundamental component of any well-constructed equity portfolio. Their stability, growth potential, ability to generate dividend growth, and risk mitigation qualities make them a good candidate for potential long-term investment success. By incorporating high-quality companies into a diversified portfolio, investors can enjoy the historical benefits of stability during turbulent times, capitalise on growth opportunities, and aim to achieve steady returns and dividends. At WisdomTree, our Quality Dividend Growth ETFs aim to leverage those characteristics of high-quality companies. With $13.6 billion of assets under management globally, our strategy focuses on high-quality companies that can grow their dividends.

Our ETF is constructed around dividend-paying companies with the best-combined rank of Earnings Growth, Return on Equity and Return on Assets within an ESG-filtered universe of companies with sustainable dividend policies. Stocks are also risk-tested using a proprietary risk screen (Composite Risk Score), which uses Quality and Momentum metrics to rank companies and screen out the riskiest companies and potential value traps. Each company is then weighted based on its cash dividends paid (market capitalisation x dividend yield), which introduces valuation discipline in this high-quality portfolio. Those steps, in combination, deliver a thoughtfully blended exposure to quality and dividend-paying companies.

Important Information

This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority. WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

The information contained in this document is for your general information only and is neither an offer for sale nor a solicitation of an offer to buy securities or shares. This document should not be used as the basis for any investment decision. Investments may go up or down in value and you may lose some or all of the amount invested. Past performance is not necessarily a guide to future performance. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice.

The application of regulations and tax laws can often lead to a number of different interpretations. Any views or opinions expressed in this communication represent the views of WisdomTree and should not be construed as regulatory, tax or legal advice. WisdomTree makes no warranty or representation as to the accuracy of any of the views or opinions expressed in this communication. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice.

Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant

or guarantee its accuracy or correctness. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.