Since its passage in late 2021, the Infrastructure Investment and Jobs Act (IIJA) has been hailed as a major step toward rebuilding America’s aging infrastructure. In our view, the IIJA is indeed a generational investment that has only just begun to impact companies in the infrastructure space. Perhaps because of the IIJA’s notoriety, discourse on how other recent legislation might contribute to US infrastructure seems lacking.

The Inflation Reduction Act (IRA) and Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act are designed to bolster US competitiveness in disruptive technologies such as renewable energy, batteries, and electric vehicles (EVs), as well as semiconductors. Both packages are likely to encourage the build-out of manufacturing capacity, distribution networks, and other American supply-chain assets, adding to the tailwinds behind US infrastructure spending.

The IRA and CHIPS Act necessitate new construction

The Inflation Reduction Act is the United States’ largest-ever investment in combatting climate change, providing around $370 billion to bolster sustainability efforts, increase energy security, and lower energy costs.¹ The bill uses tax credits as the main mechanism to attract clean tech and renewable energy manufacturing to the United States, and there’s evidence that the strategy is working.

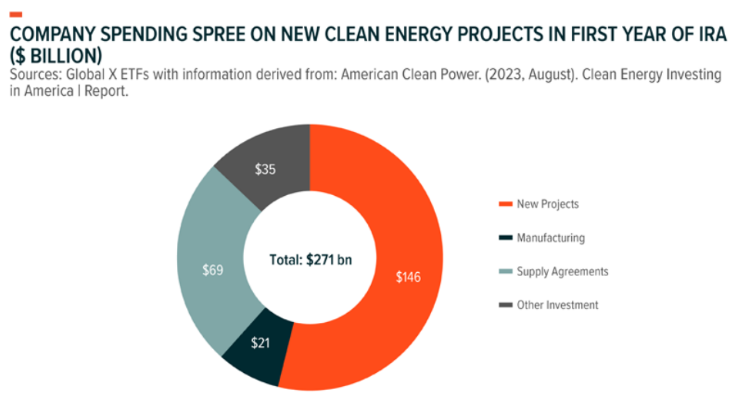

According to the White House, since the IRA’s passage in August 2022, “at least $45 billion in private-sector investment has been announced across the U.S. clean vehicle and battery supply chain.”² An estimated $150 billion has poured into the country for utility-scale clean energy initiatives, more than the total spent between 2017 and 2021.³ Some of these investments were in the works before the bill’s passage but, in our view, the IRA is largely responsible for the deluge of domestic spending on clean tech investments in recent months.

In addition to production incentives, IRA investments can also benefit infrastructure companies in various ways. For instance, as renewable energy capacity grows, the grid needs upgrades. Solar and wind power, which rely on natural resources, can be intermittent. Therefore, it’s crucial to invest in transmission infrastructure and energy storage to handle output fluctuations.

IRA investments can benefit infrastructure in various ways, like upgrading the grid for growing renewable energy capacity, especially vital due to the intermittency of solar and wind power. The US Department of Energy aims for a 60% expansion in electricity transmission capacity by 2030 to achieve clean energy goals.⁴ Another way for IRA investment to flow into the infrastructure sector is that the bill supports energy efficiency measures that could catalyse demand for retrofitting existing structures to comply with new and future standards.

The CHIPS Act incentivises the construction of new domestic semiconductor manufacturing. The bill doles out $50 billion to boost US competitiveness in semiconductors, including $39 billion in direct spending on chip production.⁵ Compared to the IIJA and IRA, the CHIPS Act is in the earliest stages of implementation, as applications for funding opened in March 2023.

However, since its passage in August 2022, over $210 billion in private investments toward semiconductor projects has been announced in 20 states, according to the Semiconductor Industry Association.⁶

Supply chain reorientation likely to keep manufacturing spending high

The COVID-19 pandemic, Russia’s invasion of Ukraine, trade tensions with China, and the fallout from these events have US companies reconsidering their decentralised supply chains and looking for security in domestic capacity. Supply-chain localisation is an increasingly common topic in corporate presentations and news stories in the United States. By the end of Q1 2023, the prevalence of supply-chain reorientation buzzwords such as “reshoring” and “onshoring” in news stories increased by almost 9 times relative to pre-pandemic levels.⁷

It’s not just talk, as increased construction activity related to manufacturing is already an ongoing, multiyear trend. As of March 2023, construction spending on manufacturing was nearly 70% higher cumulatively compared to the beginning of the pandemic, about 4x the pace of growth in other construction activity.⁸ Furthermore, total US construction spending related to manufacturing reached $108 billion in 2022, an all-time high.⁹

Conclusion: multiple opportunities for the US infrastructure space

The IIJA, IRA, and CHIPS Act add to already structurally strong demand for infrastructure development in the United States. The IIJA sets up to provide a generational boost to construction demand, and there could be overlap with IRA and CHIPS Act measures that look to reconstitute US disruptive technology supply chains. With this historical legislative support, companies across the US infrastructure space appear poised to benefit over the next several years.

Related ETF

The Global X U.S. Infrastructure Development UCITS ETF (PAVE LN) seeks to invest in companies that stand to benefit from a potential increase in infrastructure activity in the United States, including those involved in the production of raw materials, heavy equipment, engineering, and construction.

¹ The Inflation Reduction Act of 2022, H.R. 5376, 117th Cong. (2022, August).

² U.S. Department of the Treasury. (2023, March 31). Treasury Releases Proposed Guidance on New Clean Vehicle Credit to Lower Costs for Consumers, Build U.S. Industrial Base, Strengthen Supply Chains.

³ American Clean Power. (2023, April). Clean Energy Investing in America.

⁴ U.S. Department of Energy. (2022, January 12). DOE Launches New Initiative from President Biden’s Bipartisan Infrastructure Law To Modernize National Grid.

⁵ CHIPS and Science Act, H.R. 4346, 117th Cong. (2022, August).

⁶ Semiconductor Industry Association. (2023, April 25). The CHIPS Act Has Already Sparked $200 Billion in Private Investments for U.S. Semiconductor Production.

⁷ Bloomberg, L.P. (n.d.). News Trends. Accessed on May 1, 2023.

⁸ U.S. Census Bureau. (2023, March). Construction Spending, Historical Value Put in Place.

⁹ The Wall Street Journal. (2023, April 8). America is Back in the Factory Business.

The Global X UCITS ETFs are regulated by the Central Bank of Ireland.

This is a marketing communication. Please refer to the relevant prospectus, supplement, and the Key Information Document (“KID”) of the relevant UCITS ETFs before making any final investment decisions. Investors should also refer to the section entitled “Risk Factors” in the relevant prospectus of the UCITS ETFs in advance of any investment decision for information on the risks associated with an investment in the UCITS ETFs, and for details on portfolio transparency. The relevant prospectus and KID for the UCITS ETFs are available in English at www.globalxetfs.eu/funds. Investment in the UCITS ETFs concern the purchase of shares in the UCITS ETFs and not in a given underlying asset such as a building or shares of a company, as these are only the underlying assets that may be owned by the UCITS ETFs. A UCITS ETF’s shares purchased on the secondary market cannot usually be sold directly back to a UCITS ETF. Investors must buy and sell shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying shares and may receive less than the current net asset value when selling them. Changes in exchange rates may have an adverse effect on the value price or income of the UCITS ETF.

Past performance of a UCITS ETF does not predict future returns. Future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future. Neither past experience nor the current situation are necessarily accurate guides to the future growth in value or rate of return of a UCITS ETF.

Investment may be subject to sudden and large falls in value, and, if it is the case, the investor could lose the total value of the initial investment. Income may fluctuate in accordance with market conditions and taxation arrangements. The difference at any one time between the sale and repurchase price of a share in the UCITS ETF means that the investment should be viewed as medium term to long term. Any investment in a UCITS ETF may lead to a financial loss. The value of an investment can reduce as well as increase and, therefore, the return on the investment will be variable. Global X ETFs ICAV is an open-ended Irish collective asset management vehicle issuing under the terms of its prospectus and relevant supplements as approved by the Central Bank of Ireland, is the issuer of certain the ETFs where stated.

Global X ETFs ICAV II is an open-ended Irish collective asset management vehicle issuing under the terms of its prospectus and relevant supplements as approved by the Central Bank of Ireland, is the issuer of certain the ETFs where stated. Communications issued in the European Union relating to Global X UCITS ETFs are issued by Global X Management Company (Europe) Limited (“GXM Europe”) acting in its capacity as management company of Global X ETFs ICAV. GXM Europe is authorised and regulated by the Central Bank of Ireland. GXM UK is registered in Ireland with registration number 711633. Communications issued in the United Kingdom and Switzerland in relation to Global X UCITS ETFs are issued by Global X Management Company (UK) Limited (“GXM UK”), which is authorised and regulated by the Financial Conduct Authority. The registered office of GXM UK is