Diversification is an investment strategy that consists of mixing various investments within a portfolio to reduce risk: basically ‘not putting all your eggs in one basket’ for investors. The lower the correlation between the assets in the portfolio, the greater the benefits of diversification.

Gold has a low correlation with traditional assets

As shown in Figure 1, gold has a low correlation with stocks and bonds. While gold is technically a commodity, it behaves very differently to most cyclical commodities. The drivers of gold price (such as inflation, bond yields, exchange rates and market sentiment) make the metal appear more like a currency than a regular commodity. So, even though gold futures are part of a broad commodity allocation, they have a relatively low correlation with the rest of the commodity complex (0.37) and so they can also be considered as a separate line item for further diversification.

Figure 1: Correlation matrix

Gold has strong defensive traits

Gold prices tend to rise in financial crises, economic downturns, and geopolitical shocks. Equities are quite the opposite: they tend to falter in financial crises, early phases of economic downturns, and are sometimes vulnerable to geopolitical shocks.

Gold has, historically, performed well during equity market crises. Gold has returned positive performance in 15 out of the 20 worst quarters of performance for the S&P 500. Of the remaining five quarters, gold has outperformed the S&P in four quarters. The only quarter when gold fell harder than equities – Q3 1975 – came a year after abnormally large gains in gold prices (in 1974 gold prices rose 72% and then corrected downward 24% in 1975).

Figure 2: Gold performance during the 20 worst quarters for US equity markets

Gold performs well in deep recessions and strong expansions

Gold has, historically, performed well in times of inflation. Given that inflation is often elevated in times of strong economic growth, gold is not just a defensive asset. In fact, no other asset behaves like gold: the metal performs stronglyin both economic downturns and upturns. This uniqueness in behaviour once again makes it a strong candidate for diversification.

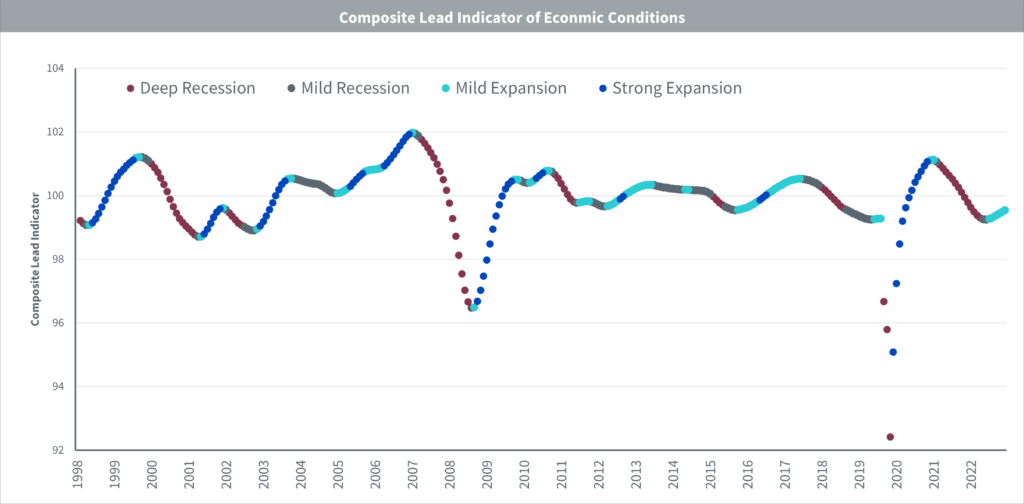

As a point of illustration, we look at the performance of assets in different points in the economic cycle. Composite Leading Indicators (CLIs), provide signals of turning points in the economic cycle1. Figure 3 below shows various phases of the economic cycle derived from CLIs.

Figure 3: Composite Leading Indicator of economic conditions

Using the CLI from Figure 3, we look at the performance of assets in Figure 4. Gold performs better than any other asset in deep recessions. It also strongly outperforms defensive assets in times of economic expansion. It even outperforms bonds (government and corporate) in times of mild recession.

Figure 4: Asset performance in different phases of the economic cycle, with gold and silver

How much gold should an investor add to a portfolio to benefit from diversification?

By adding gold to a traditional portfolio of stocks and bonds, it’s easy to see that the Sharpe ratio (the return of portfolio relative to its risk) can be improved. In Figure 5, we start with an illustrative portfolio of 60% bonds and 40% equities, with no gold allocation (at 0 on the x-axis). That has a Sharpe ratio of 0.37 (greyline, left axis). As we increase the allocation to gold (moving along the x-axis) and keep the rest of the example portfolio weights in a 60/40 bond-equity allocation, the Sharpe ratio starts to rise. It peaks at a gold allocation of 12%2, with a Sharpe ratio of 0.41 and then declines with higher gold allocations. Gold can be volatile asset and, therefore, detracts from the Sharpe ratio after a certain point. This is a lot more than what we believe most investors currently allocate to gold.

Another way of thinking about optimisation is to consider drawdowns: what is the worst expected performance in a 12-month period? The orange line on the right axis shows that allocations of gold up to 30%3 reduce the worst expected performance in a 12-month period. This is a lot more than what most investors currently allocate to gold.

Figure 5: What was the optimal allocation to gold from 1973 – 2023?

Conclusions

Gold behaves very differently to stocks and bonds and, thus, has a low correlation with both assets. That’s why it is a great portfolio diversifier. Gold as a defensive asset provides a hedge against financial and economic turbulence. But it also performs very well in times of inflation, which is often a by-product of strong economic growth. Gold is unique in this manner and, therefore, very difficult to replace with other assets. One of the benefits of diversification is to reduce risk, as we can see in the Figures above.

Implementation solutions

Physical Gold exchange-traded commodities (ETCs) provide a simple, cost efficient and secure way to access Physical Gold by providing a return equivalent to movements in the Physical Gold spot price less the applicable management fee. WisdomTree is a market leader in physically backed gold ETCs. Since creating Europe’s first gold ETC almost two decades ago, we have continued to build our suite of gold products, offering clients best in-class features and price competitive solutions.

WisdomTree Core Physical Gold (GLDW), for example, is fully backed by London Bullion Market Association (LBMA) gold bars produced after January 2022, which are bars conforming to the latest Responsible Sourcing Guidance offered by the LBMA and has a management fee of only 0.12%.

For investors looking to hedge out dollar exposure or protect their portfolio against dollar weakness relative to GBP, WisdomTree also offers WisdomTree Physical Gold – GBP Daily Hedged (GBSP), which has a management fee of 0.15%.

The physical gold backing both ETCs is allocated and stored in London vaults by reputable and highly secure custodians; for more information see WisdomTree’s Gold Strategy Page.

Sources

1 Source Or more precisely fluctuation of economic activity around its long-term potential level.

2 Source Remainder of portfolio maintains a 60/40 split, that is, 53% bonds and 35% equity.

3 Source Remainder of portfolio maintains a 60/40 split, that is, 42% bonds and 28% equity.

4 Source WisdomTree Physical Gold – EUR Daily Hedged (GBSE) and WisdomTree Physical Gold – GBP Daily Hedged

(GBSP) which are physically-backed by LBMA gold.

5 Source WisdomTree Gold 1x Daily Short (SBUL) and WisdomTree Gold 3x Daily Short (3GOS), which are synthetic

exposures.

6 Source WisdomTree Gold 2x Daily Leveraged (LBUL) and WisdomTree Gold 3x Daily Leveraged (3GOL), which are

synthetic exposures.

Important Information

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

The information contained in this document is for your general information only and is neither an offer for sale nor a solicitation of an offer to buy securities or shares. This document should not be used as the basis for any investment decision. Investments may go up or down in value and you may lose some or all of the amount invested. Past performance is not necessarily a guide to future performance. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice.

The application of regulations and tax laws can often lead to a number of different interpretations. Any views or opinions expressed in this communication represent the views of WisdomTree and should not be construed as regulatory, tax or legal advice. WisdomTree makes no warranty or representation as to the accuracy of any of the views or opinions expressed in this communication. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice.

Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability