At InvestEngine, we’re always looking for new ways to make long-term investing more simple and more effective.

We have a range of tools on the platform to help with transparency and control, and our selection of over 550 ETFs offers unparalleled choice for anyone looking to grow their wealth the easy way.

We think the next step is giving investors a better way to invest regularly. So, just as we become recognised as a Which? Recommended Investment Provider, we’re ready to present our brand new solution for long-term, smart investing: Savings Plans.

A new way to invest

The vision of Savings Plans is to offer automated, regular investing built to suit each individual investor.

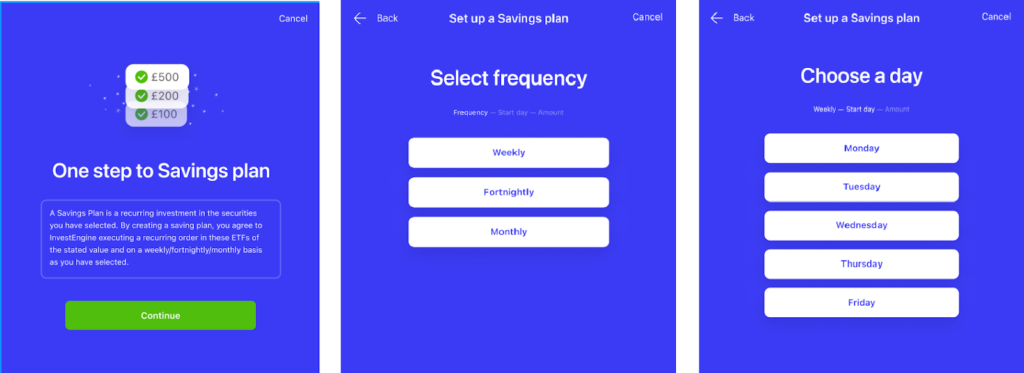

Monthly direct debits are a part of many investment platforms, but we’ve taken the feature one step further. With an InvestEngine Savings Plan, you can invest weekly, bi-weekly or monthly using the latest Open Banking technology called Variable Reccurring Payments or VRPs. It’s completely up to you when you invest and how much. You can even choose which day of the week, fortnight or month that the money is deposited.

So, whether you want to automatically invest just after payday, or throw a little into your portfolio every week, you can create a plan that works for you in seconds.

Everything InvestEngine has to offer

Then, it’s over to our range of smart investment tools to put that money to work for you.

Our features allow you to automate as much, or as little, of your investing as you like. For example, we can automatically put to work any unused cash that builds up in your account. This is invested based on the portfolio you create at the start, so your investments always stay on track.

You’ll also have full visibility of where your money is going. InvestEngine customers have access to a comprehensive, real-time, fully transparent view of the assets they’re invested in. This includes a full breakdown of everything from the geographies to the individual holdings.

Because Savings Plans allow investors to take a more hands-off approach to their finances, over time the asset weights in the portfolio can shift as some assets grow more than others. We have a powerful rebalancing tool, which means you can reset your portfolio to your chosen asset allocation with just one tap.

And, last but not least, Savings Plans are also available on our Managed accounts. You’ll have access to all the benefits of automation, with the added benefit of the expertise of our experienced portfolio managers. Follow the link below if you want to find out more about what a managed account could do for your investing.

Timeless strategy made simple

A major benefit of Savings Plans is that it gives investors an easy way to take advantage of the well-established risk management strategy of pound cost averaging (you might have heard it referred to as dollar cost averaging).

First coined by economist Benjamin Graham in 1949, pound cost averaging is the process of staggering your investments over time in the hope of nullifying any negative market swings. Ultimately, it’s the strategic opposite of trying to “time the market”.

We’ve gone into more detail about pound cost averaging and how it works in this article, but it’s a powerful way of removing the stress from investing and focusing on the bigger picture. Savings Plans allow you to do just that.

So, whether you want to build your own portfolio or have one managed by our team of experts, Savings Plans compiles the best of InvestEngine into one package.

It’s where affordability, choice, flexibility and automation meet, to provide one of the most effective and straightforward ways to grow your wealth through ETF investing. We can’t wait to see how people get the service working for them.

Important information

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt you may wish to consult a professional adviser for guidance.

Tax treatment depends on personal circumstances and is subject to change, and past performance is not a reliable indicator of future returns.