This year has had its fair share of ups and downs for investors, but what’s moved markets most and where have InvestEngine investors been putting their money so far in 2025?

What’s moved stock markets most in 2025?

2025 started off shaky as China’s DeepSeek released a new, cheaper AI model to rival big US tech. Sky-high tech valuations came under fire, causing a sharp, but brief, tech sell-off. NVIDIA was the most affected with almost £500 billion wiped off its valuation. However, by market close the major indices finished in the green.

Then came President Trump’s tariffs. Worries started to build as soon as Trump entered the White House. Just a couple of months later, the US President unveiled his tariff plans in what he dubbed ‘Liberation Day’. In just under a week US markets had fallen over 12%, while UK markets had dropped by almost 11%.

The odds of a US recession jumped to 40%, four out of every five US CEOs expected a recession, and 70% of S&P 500 companies went to mention tariffs in their earnings calls.

On 9 April, Trump decided to pause tariffs on those countries willing to negotiate. The market rallied, with US stocks climbing 9.5% — its biggest daily one-day rally since the Great Financial Crisis in 2008.

Markets remained volatile for the rest of April, but the US then had its best May since 1990, with the FTSE 100 and the rest of the world following.

Stocks then rose fairly consistently over the next few months after posting some solid earnings results, amidst an improving outlook for inflation and interest rates.

And while artificial intelligence (AI) bubble talk may have dominated headlines over the last couple of months, markets have stayed steady, helped by a record US earnings season, albeit with some bumps along the way.

S&P 500 all-time high: how to invest in the US market

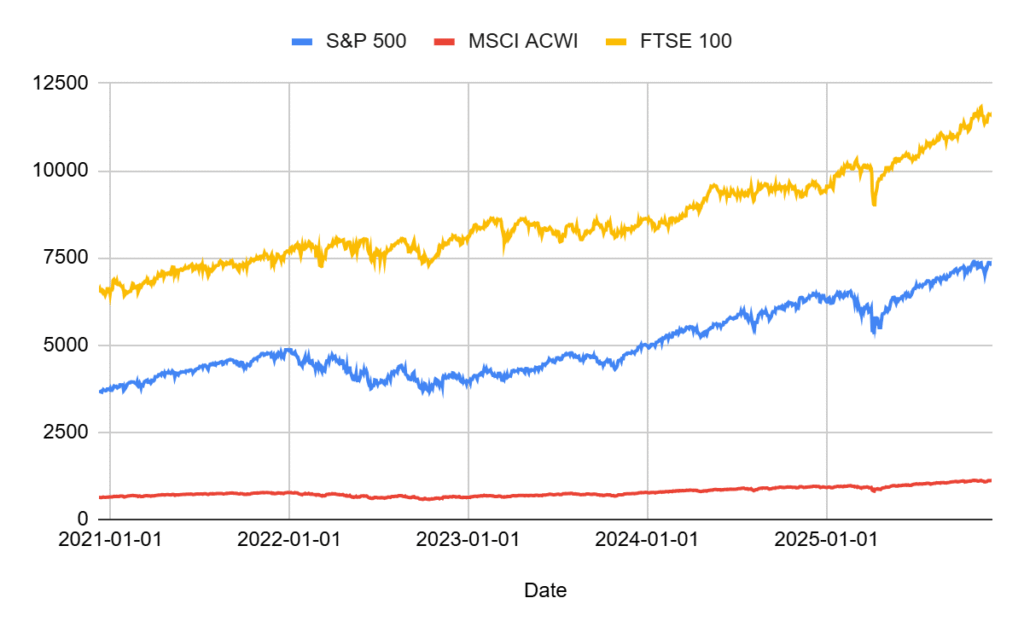

S&P 500, FTSE 100 and MSCI All Country World Index 5-year stock market performance

Past performance is not indicative of future performance. Source: Bloomberg, 05/12/2025.

What have InvestEngine clients been buying?

This list of ‘Top ETFs’ is based on the most bought ETFs on InvestEngine’s platform. Top ETFs have been calculated by most bought (by number of clients) between 1 January 2025 and 15 December 2025.

This ETF aims to achieve short-term returns higher than the benchmark rate SONIA with lower volatility. SONIA stands for ‘Sterling Overnight index Average’, and is the average interest rate banks lend money to each other overnight.

The ETF is aimed at investors looking for a less-volatile investment, but with a little more growth than just holding cash. It invests in very short‑term, high‑quality debt from governments and companies, making it less risky.

This fund could appeal to investors who need their money to be relatively accessible and want to avoid the ups and downs of the stock market.

This ETF aims to mirror the performance of the S&P 500 index, offering investors a diversified way to invest in the 500 largest companies in the United States.

This ETF might appeal to those looking to invest in the US market, and who are wanting to benefit from the overall growth and success of these companies, without having to invest in each one individually.

This ETF offers investors the opportunity to invest in a wide range of companies from across the globe, including both developed and emerging markets. It aims to mirror the performance of the FTSE All‑World index, providing diversified exposure to the world’s stock markets.

This ETF might appeal to those looking to spread their investment across different countries and sectors, potentially reducing risk while potentially benefiting from broad global market growth.

This ETF offers investors broad exposure to a diverse range of companies across both developed and emerging markets worldwide. It includes a variety of large and mid‑sized companies from numerous sectors, like technology, healthcare, finance, and consumer goods.

By tracking a specific index, this ETF aims to reflect the overall performance of global stock markets, encompassing companies from regions including North America, Europe, and Asia.

Investors could find this ETF appealing if they’re looking to diversify their portfolios and invest in a wide array of global investment opportunities. It’s suitable for individuals who want to participate in the growth potential of both developed and emerging economies while spreading their investment risks.

This ETF invests in a broad selection of companies from developed markets around the world, providing exposure to a diverse range of industries and regions. It tracks an index that includes large and mid‑sized companies across North America, Europe, and the Asia‑Pacific region.

This ETF could appeal to investors looking for global diversification through a single investment, allowing them to gain exposure to well‑established companies in developed economies. Investors who want a simple and diversified way to participate in the global economy may find this fund an attractive option.

What to consider before buying an ETF

When comparing ETFs, it’s worth digging a little deeper than recent returns.

Start by looking at what the fund actually tracks.

A global index like the FTSE All-World spreads your money across thousands of companies, while something more focused, like the S&P 500, tilts heavily toward the US and big tech names. Knowing the index helps you understand where your money is really going.

Costs matter too. Most ETFs are already low cost, but even a small difference in fees can add up over time, especially if you’re investing regularly. Larger funds also tend to trade more smoothly, which can save you money when buying or selling.

Finally, think about how the ETF fits into your wider portfolio.

Is it a core holding you plan to build around, or a focused addition that targets a theme like gold or technology?

Getting that mix right can make a big difference to how your portfolio performs and how comfortable you feel holding it through market ups and downs.

For more information on each ETF, check out its factsheet where you can also find its Key Investor Information Document.

What are the risks of buying ETFs?

ETFs make investing simple, but they still come with risk. Markets move, and prices can fall just as easily as they rise. Even broad funds can drop in value during periods of uncertainty, as seen earlier this year when rate cuts and economic data caused sharp swings across global indices.

Some ETFs are concentrated in certain regions or sectors, which can amplify both gains and losses. Diversification helps smooth the ride, but it can’t remove risk completely. Currency movements can also affect returns on international funds, even when the underlying companies are performing well.

The key is to take a long term view. If you understand what you own and why, short term market moves become less stressful and your investing decisions more consistent which is often what matters most in the end.

How to buy ETFs easily with InvestEngine

InvestEngine makes it straightforward to invest in top ETFs, whether you’re building a long term portfolio or adding a few new funds for diversification.

Why use InvestEngine?

✅ No trading or platform fees

Buy and sell ETFs commission free, so more of your money stays invested and working for you (ETF costs apply).

✅ Powerful portfolio tools

Track your holdings, compare ETFs, and rebalance whenever you need all in one simple dashboard.

✅ Automate your investing

Set up a Savings Plan to invest regularly, choosing how much and how often. It’s an easy way to stay consistent and build wealth over time.

✅ Flexible account options

Invest through an ISA, SIPP, general investment account, or Business account, all with no platform fees on DIY portfolios.

With these tools, InvestEngine makes it easy to own the ETFs that have led the market in 2025 and prepare your portfolio for the opportunities ahead in 2026.

Pound-cost averaging – the smart way to invest during stock market uncertainty?

Important information

Capital at risk. The value of your investments may go down as well as up, and you may get back less than you invest. Past performance is not indicative of future performance.

ETF costs apply. If in doubt, you may wish to consult a professional adviser for guidance.