Is growth investing really dead? And is value investing back in vogue?

That’s what numerous headlines would have investors believe. But what’s the difference between growth and value investing, why are investors shifting their attention to value stocks now, and how can you invest in both?

What is growth investing?

Growth stocks are shares in companies where investors expect above-average future growth in sales and profits. Because so much of the hoped-for success sits in the future, growth stocks often trade on higher valuations today (for example, higher price-to-earnings multiples).

What does a typical growth stock look like?

- More profits reinvested into expansion rather than paid out as dividends

- More sensitive to interest rate expectations (because future profits are ‘discounted’ back to today)

- Often concentrated in themes where cashflows are being paid further in the future rather than today (e.g. tech companies which don’t pay a dividend)

Classic growth stocks include the likes of NVIDIA, Amazon, Alphabet, and other large technology stocks.

What is value investing?

Value stocks are shares that look cheap relative to their fundamentals (‘fundamentals’ means a company’s fundamental business metrics — things like their earnings, or sales, or free cashflow).

What does a typical value stock look like?

- Lower valuation multiples (cheaper on price-to-earnings, price-to-book, etc.)

- Often higher dividend yields

- More exposure to sectors that wax and wane with how well the economy’s doing (financials, industrials, energy), though value can show up anywhere

Examples of value stocks include banks (HSBC, JP Morgan), oil companies (BP, Shell), and telecoms companies (Verizon, AT&T). Value investing is basically asking: ‘Is everyone being a bit dramatic about this?’

It’s worth remembering that value doesn’t automatically mean good, and growth doesn’t automatically mean expensive nonsense. They’re merely labels describing how the market is pricing a share today, not whether the company is good or bad.

Growth stocks are often great companies, but that doesn’t guarantee great returns from today’s price. A great company can be a terrible investment at the wrong price, and vice versa.

Why are investors looking at ‘cheaper’ parts of the stock market?

So far in 2026, one big theme has been market leadership broadening, away from the handful of mega-cap tech names that dominated returns in recent years. And that’s been happening because investors are questioning how much good news is already priced into the biggest growth winners.

They’re worried that as Big Tech ramps up AI spending, markets have started to demand clearer evidence of payoff, which has weighed on parts of the tech sector.

That’s why there have been some sharp selloffs in US software/data services and investors are rotating toward more value-oriented areas like consumer staples, energy and industrials. And looking beyond the US, flows have favoured ex-US stocks for the same reasons.

Value vs growth investing: which has performed best over time?

The idea that cheaper value stocks tend to outperform more expensive ones over the long run is often called the value premium. It’s a well-documented pattern in academic research, including classic work by Fama and French showing that value characteristics help explain differences in average returns.

There are two main explanations:

- Value is riskier, so it pays a risk premium. Value companies can be more economically sensitive, more leveraged, or simply more exposed when things go wrong. If investors dislike that kind of risk, they’ll only hold it at a price that offers higher expected returns over time. No pain, no premium.

- We overpay for excitement. Humans love a good story. In strong bull markets we can extrapolate recent success too far, paying up for glamour growth companies and neglecting boring or temporarily-troubled businesses.

Should you invest in growth, value or both?

It’s tempting to try to time shifts between value and growth, especially if you think interest rates give a clear signal. In practice, style leadership can last for years, and the obvious indicators (like rates rising or falling) don’t always line up neatly with what markets do.

Value and growth can both be cyclical, but calling the turning points consistently is hard.

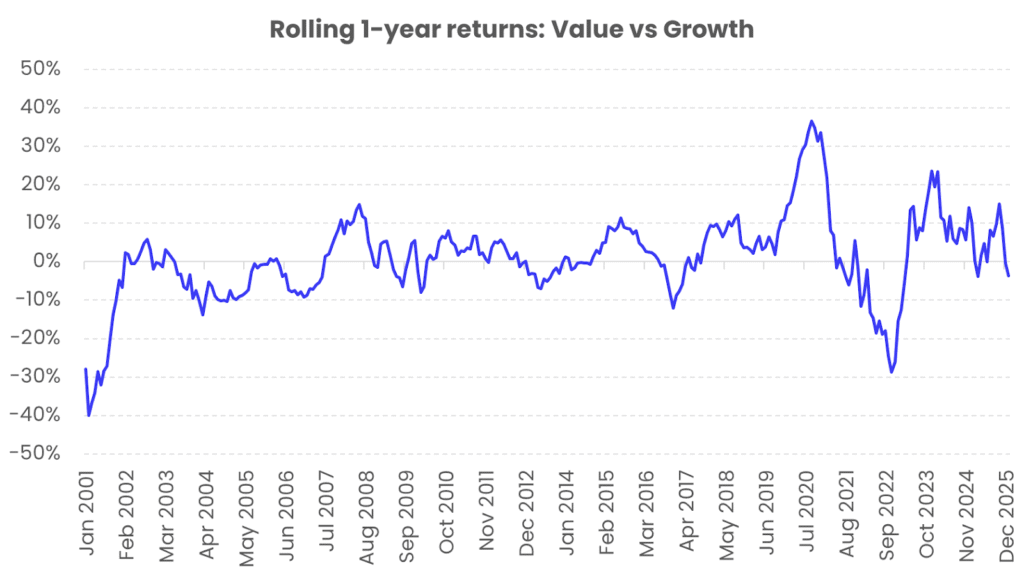

The chart below shows how cyclical the two styles can be.

When the line is above 0%, growth stocks have outperformed value over the past year. When it’s below 0%, value has led. The bigger swings show a larger difference in returns.

Rolling 1-year total return difference between the MSCI World Growth Index (GBP) and the MSCI World Value Index (GBP). Past performance is not indicative of future performance. Source: Bloomberg.

For most investors, a balanced approach is a good starting point, as value and growth tend to perform well at different times.

In 2022, for example, the MSCI World Growth Index (GBP) was -21% while its value equivalent was +6%. The following year, value rose 7%, while growth rose over 30%.

The simplest balance is just owning a broad global equity index, as it naturally holds both value and growth. If you do want a tilt, consider keeping it modest (e.g. a satellite allocation) and rebalance occasionally rather than chasing what just worked.

How to build a core-satellite investment portfolio

Balance also protects you from the most expensive mistake in investing: changing course at exactly the wrong time. If you hold both styles and rebalance occasionally, you’re naturally selling what’s become expensive and topping up what’s fallen out of favour, without needing to predict the next rotation.

So when the headlines declare ‘growth is dead’ or ‘value is back’, remember that styles rotate, stories change, and markets move on. A balanced portfolio keeps you participating through the whole cycle, not just the bit that’s fashionable today.

How to rebalance your ETF portfolio

Value vs growth investing: 4 ETF ideas

2 value ETF ideas

Xtrackers MSCI World Value

This ETF invests in companies that are considered undervalued, meaning their stock prices are low compared to their overall financial health and potential for growth.

It aims to invest in companies that may be overlooked by the market, but have solid fundamentals. It targets companies that might be positioned for growth once their true value is recognized.

This ETF includes a range of businesses from different sectors and countries, allowing for diversified exposure.

Overall, this ETF offers a way for investors to participate in the potential upside of undervalued global companies while spreading risk across various holdings.

iShares MSCI USA Value

This ETF focuses on investing in US companies that are considered to be undervalued based on certain financial metrics, such as low price‑to‑earnings or price‑to‑book ratios.

The goal is to track an index that selects stocks displaying characteristics of value, meaning they’re trading at lower prices compared to their fundamentals.

The fund invests in a wide range of sectors across the US economy, offering a diversified approach to value investing.

2 growth ETF ideas

iShares S&P 500 Information Technology

This ETF invests in companies from the information technology sector that are part of the S&P 500 Index.

These companies are involved in areas like software development, hardware production, and digital services.

The fund provides exposure to large technology firms that drive innovation and technological advancements, with businesses ranging from semiconductor manufacturers to cloud computing providers.

WisdomTree Artificial Intelligence

This ETF focuses on investing in companies involved in the development and application of AI technologies.

It seeks to track the performance of firms that are leaders in AI, including those engaged in areas such as machine learning, robotics, natural language processing, and autonomous systems.

The fund provides exposure to a global range of companies that are driving innovation in AI, spanning industries such as technology, healthcare, and industrials.

Important information

Capital at risk. The value of your investments may go down as well as up, and you may get back less than you invest. Past performance is not indicative of future performance.

ETF costs apply. If in doubt, you may wish to consult a professional adviser for guidance.