Over the next month, you’re probably going to see plenty of headlines on the ‘Santa Rally’, but what is it, does Christmas really move the stock market, and can investors benefit?

What is the ‘Santa Rally’ and how long does it last?

The Santa Rally describes the historical tendency that stock markets rise during the last five trading days of December and the first two trading days of January. The term was made popular by Yale Hirsch in the 1972 edition of the Stock Trader’s Almanac.

Do stock markets go up during the ‘Santa Rally’?

Looking at data from the last 30 years, the average increase during this 7-day trading period has been around 0.64% when looking at the S&P 500.

These gains have happened 20 out of 30 years since 1995 with the largest recorded gains at 6.83% and the largest decline at 3.77%.

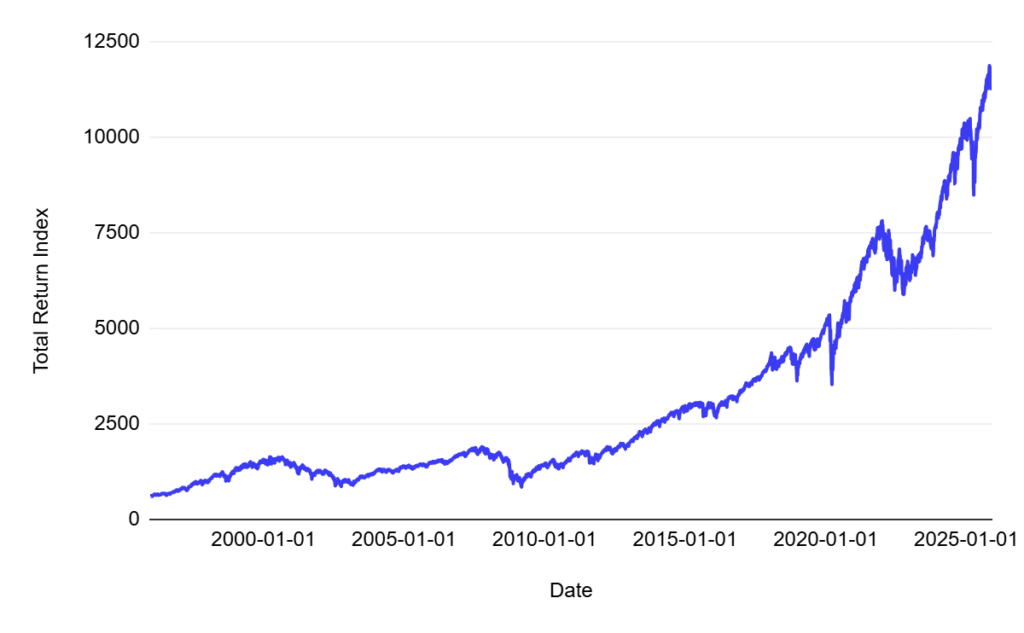

US stock market performance over the last 30 years

Past performance isn’t a guide to the future. Source: Bloomberg, data from 1995 to 2025.

However, although the Santa Claus Rally is statistical and has happened in more years than not, it’s still not a guarantee.

S&P 500 Index versus the Nasdaq-100 Index: how are they different?

What causes the stock market Santa Rally?

While plenty of explanations have been suggested over the years, there’s still no consensus on a single cause of the stock market Santa Rally.

Here are some of the main factors that investors think could be the cause of the Santa Rally.

Investor sentiment and holiday optimism — the holiday period tends to pit investors in a more positive mindset which can encourage buying rather than selling.

New Year repositioning — investors and investment managers may rebalance portfolios, invest year-end bonuses, or clean up books ahead of the new financial year, helping push up stock market prices.

Lower trading volumes and thinner liquidity — lots of financial professionals take holidays and time off in December and early January. With fewer market participants and lower liquidity volumes, buying can have a disproportionate impact on prices.

Record US stock market earnings season: what investors need to know

Can investors benefit from the Santa Rally?

The Santa Rally is an interesting theory and some investors might see this as a sentiment window or even a short-term trading window. However, investment decisions based on expected seasonable patterns are similar to looking at a horoscope.

It may be a reliable window of modest gains but it’s not guaranteed and completely disregards what’s happening with the economy right now, interest rates, valuations and current geopolitical risks too.

While the fear of missing out might make it tricky, investors should ignore trying to trade the Santa Rally and instead stay focused on investing for the long term.

After all, time in the market, instead of trying to time it, is what’s going to give you the best chance of growing your wealth over the long term.

S&P 500 at all-time highs: how to invest in the US stock market

Important information

Capital at risk. The value of your investments can go down as well as up, and you may get back less than you put in. Past performance isn’t a guide to future returns. ETF costs also apply.

This content is for information only and is not financial advice. If in doubt you may wish to consult a professional adviser for guidance.