Rachel Reeves’ second Autumn Budget is less than a week away. Rumours have been swirling but, as we get closer to the day, more details are starting to take shape.

Perhaps the biggest news is that the Chancellor appears set to stick to Labour’s manifesto pledge on income tax. After strongly considering income tax rises, the latest speculation is that this plan has been shelved for now.

For investors, however, there are some significant changes on the table. Potential tweaks to ISA allowances, salary sacrifice on pensions and inheritance tax are all things to consider, particularly for high earners.

So, here are three last-minute things you can do to prepare for next Wednesday’s Autumn Budget.

1. Make the most of pension power

In place of a pledge-busting income tax hike, Chancellor Rachel Reeves is reportedly considering freezing or lowering income tax thresholds — the salary levels at which you start paying more in tax.

As it stands, these thresholds are frozen until 2028, with speculation this could be extended to 2030.

What this means in practice is that, as salaries grow with inflation, more and more people move into higher tax brackets.

The solution? Consider pension contributions. Because you get tax relief at your highest marginal rate, these are most powerful for high earners.

For higher rate tax payers, a £20,000 pension contribution actually costs just £12,000. The government pays 20% (£4,000) and you can claim another 20% back in tax relief.

For additional-rate tax payers, the amount you can claim goes to 45%, so a £20,000 contribution costs you even less.

So, if you are (or are about to become) a higher-rate or additional-rate taxpayer, pension contributions are a powerful way to make the most of the tax tools available. For basic rate taxpayers, you still get the 20% government uplift on contributions.

The income tax freeze might mean you paying a higher rate than you’re used to, so considering adding money to your pension and making the most of extra tax relief is a no brainer.

They’re about more than just saving for your future – the powerful tax benefits are something all investors should be aware of.

Bonus: make sure you’re maxing out your workplace pension contributions where possible. Free money from your employer is too good a deal to pass up.

2. Use your ISA allowances

There have been a number of rumours about changes to ISA allowances in the upcoming Budget. The most pervasive is that Reeves could halve the Cash ISA allowance from £20,000 to £12,000.

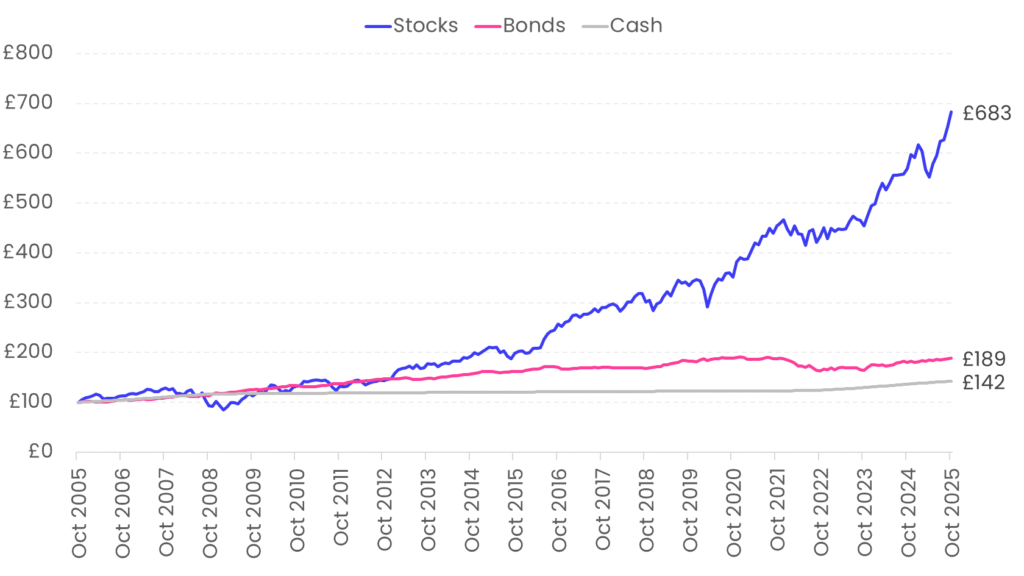

The aim is to get more people investing. Though it comes with more risk than assets like cash, investing in global markets has the potential to lead to greater gains down the line.

The chart above compares the growth of the global investment market (in the form of the MSCI World) against the growth in cash over the same 20 year period.

So, with potential changes coming, investors could consider a Stocks and Shares ISA to maintain their £20,000 annual tax-free allowance. If you put over £12,000 into a Cash ISA each year, you’ll need to find a new home for the excess.

For those more comfortable with lower-risk options, it might be worth considering Overnight Rate ETFs. These aim to match interest rates in the UK — based on the government’s SONIA rate benchmark — and currently target a 4% return.

InvestEngine ISAs are flexible, too, which means you can deposit and withdraw without affecting your yearly allowance. You also don’t pay a penny in withdrawal or platform fees when you do so.

So, if you want to make the most of your allowances before the Budget, you won’t be locked into what you choose to do.

3. Use your family to help you plan

If you have a spouse or a civil partner, planning your finances together can be beneficial. This is particularly relevant when one pays less in tax (or no tax at all).

You’ll both have ISA allowances and SIPP allowances, as an example. If one partner isn’t maxing out theirs, the other could gift investments to protect more of their money from the taxman. There is no tax at all on gifts between spouses.

You can also gift to others and use your annual gift allowance, which is currently £3,000. A couple could even combine their exemptions.

Currently, if you live for seven years after passing on a gift to your family, it isn’t subject to any inheritance tax. If you pass away three to four years after, the gift is subject to a 32% tax – this figure rises to 40% if gifted just two years before death.

The government is reportedly considering a lifetime cap on the value of gifts a person can pass on before they die. So, it might be worth passing gifts on before the Budget if you were already planning to, and it still makes sense for you (though remember, any changes are unlikely to kick in right away).

We don’t know exactly what will happen in the Budget, but those planning to use their family to lessen their tax burden might want to consider getting the ball rolling now.

Ultimately, any sensible financial prep you can do before the next week’s announcements could be beneficial. Tax tweaks or changes to the rules on ISAs can force investors into action, particularly when deadlines are set for changes to take effect – making the most of the tools available to you ahead of time is always good practice.

Important information

Capital at risk. The value of your investments can go down as well as up, and you may get back less than you put in.

Tax treatment depends on individual circumstances and is subject to change. Scottish tax bands are different. ETF costs also apply.

This content is for information only and is not financial advice. If in doubt you may wish to consult a professional adviser for guidance.