If you’ve opened your news app this year, you’ve probably seen stories about AI reshaping industries, defence spending hitting record highs, and governments racing to secure energy security.

Each of these headlines ties into what investors call ‘megatrends’: the long-term forces or ‘themes’ reshaping the global economy and everyday life.

2025 was a strong year for thematic investing. After a year dominated by big technology names, smaller and faster-growing companies are now starting to shine.

In fact, over half of the investment themes tracked by WisdomTree have beaten the global stock market this year.

The strongest trends?

Nuclear energy, defence, rare earth miners, quantum computing and renewable energy, among others.

Megatrends: a different kind of growth strategy

For retail investors, megatrends offer a way to invest in powerful, long-term forces reshaping industries and societies.

But capturing those trends isn’t always straightforward.

Many investors fall into the trap of trying to pick the ‘winning’ theme at the ‘right’ time, chasing what’s hot and exiting when sentiment cools.

History shows that when hype overtakes fundamentals, even promising ideas can underperform.

The key is learning to separate long-term growth drivers from short-term excitement, and building an investment portfolio that lasts well beyond the next news cycle.

That’s why investing across a range of these growth themes is so important. It helps smooth out the inevitable ups and downs that come with investing in individual trends, while keeping investors aligned with the broader themes shaping the global economy.

When WisdomTree launched the WisdomTree Megatrends UCITS ETF, the aim was clear: to build a portfolio that could identify tomorrow’s winners, not just follow today’s big names.

While much of the market remained focused on the ‘Magnificent 7’ mega-cap tech stocks, we chose to look beyond them, towards the next generation of long-term growth themes.

That approach has paid off.

Since its launch in October 2023, the Megatrends strategy has outperformed the Nasdaq 100 by 6.33% and the MSCI All Country World Index by 19.85%, despite only investing around 3% in the Magnificent 7.

Instead, the Megatrends ETF invests across high-potential areas like AI, clean energy and global defence, sectors that could define the next decade of market growth.

In total, the Megatrends strategy has delivered a 79% return since it launched, compared to 59.1% for the MSCI All Country World Index.

This shows that diversification across powerful themes can be a strength rather than a compromise.

WisdomTree Megatrends strategy: how is it different?

Since launch, the WisdomTree Megatrends UCITS ETF has outperformed its five biggest peers by more than 21% on an annualised basis.

So, what’s driven this outperformance?

The WisdomTree Megatrends strategy is built around a disciplined, three-layered approach designed to adapt to changing markets:

- Identifying powerful long-term themes

Our research team selects long-term trends with strong growth potential, from sustainability to digital transformation.

- Tactical flexibility

The portfolio adjusts every three months to reflect what’s doing well and stay aligned with the strongest themes. The portfolio will tilt towards stronger-performing themes by buying more of what’s doing well and selling what’s not doing as well. This helps it benefit in both optimistic and more cautious markets.

- Stock selection

Within each theme, we focus on companies that are most closely aligned to the underlying trend. To do this we leverage specialist knowledge to make sure the portfolio is focused and staying true to its goal. For example, we partner with Wood Mackenzie, the global commodity consultancy, to inform which stocks we pick within the strategic metals and rare earth miners theme.

So far, this differentiated approach has led to differentiated performance.

Which trends do we invest more and less in?

| Tactical positioning compared to strategic one (18 July 2025) | |||

| Theme | Positioning | Tactical Signal | Weight |

| Aging Population | Underweight | 50% | 1.8% |

| Artificial Intelligence & Big Data | Overweight | 150% | 9.4% |

| Blockchain | Overweight | 150% | 6.9% |

| Cloud Computing | Underweight | 50% | 9.7% |

| Cybersecurity | Underweight | 50% | 10.0% |

| Digital Infrastructure | Underweight | 50% | 4.1% |

| Energy Transition Materials | Overweight | 150% | 4.6% |

| HealthTech | Underweight | 91% | 3.5% |

| Nuclear | Overweight | 150% | 6.3% |

| Quantum Computing | Overweight | 150% | 6.4% |

| Rise of China Tech | Overweight | 150% | 8.1% |

| Rise of EM Consumer | Underweight | 50% | 4.4% |

| Rise of Tension | Overweight | 150% | 7.4% |

| Rise of the Middle Class | Underweight | 50% | 1.7% |

| Semiconductors | Overweight | 150% | 2.8% |

| Sustainable Energy Production | Overweight | 150% | 6.1% |

| Sustainable Energy Storage | Overweight | 150% | 3.1% |

| Sustainable Food | Underweight | 50% | 3.8% |

What’s been driving recent performance of megatrends?

The WisdomTree Megatrends UCITS ETF (WMGT) has delivered 10.2% outperformance versus the MSCI All Country World since the most recent rebalancing in July 2025.

Four themes stood out:

- Renewable energy (+1.79% contribution) rebounded strongly as global energy demand sped up.

- Rare earth and strategic metals miners (+1.54%) benefited from investors’ refocusing on resource security.

- Rise of China technology (+1.62%) remained resilient following major innovation announcements earlier in the year.

- Blockchain (+1.45%) continued to grow as regulation improved, especially in the US.

In total, 14 out of the 18 themes added value during the period, which is a strong sign of how balanced the performance drivers have been.

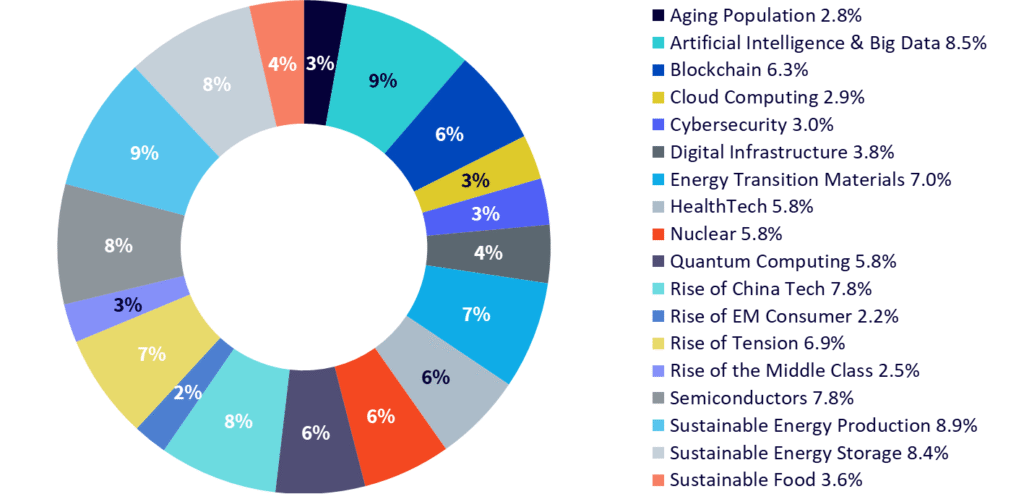

How much do we invest in each theme?

Importantly, the WisdomTree Megatrends UCITS ETF isn’t designed to be a large part of your ‘core’ portfolio. Instead it’s there to help you invest in the themes you care about and help add some extra diversification to an already well-diversified portfolio.

Looking ahead with megatrends

As the global economy evolves, thematic investing is becoming an essential way to invest in long-term growth.

The WisdomTree Megatrends strategy brings together the most powerful long-term trends shaping our world, from clean energy and digital innovation to new frontiers in science and technology, all within one, well-balanced strategy.

By investing in Megatrends, you’re not just following today’s market leaders, but positioning for the next generation of growth.

If you’d like to find out more about megatrends investing, please visit our strategy page or insights centre.

You can explore WisdomTree’s range of ETFs on InvestEngine here.

FAQs on megatrends outpacing tech giants

1. What are megatrends in investing? Megatrends are long-term forces shaping the global economy, such as AI, clean energy, defence, and digital innovation. They focus on structural shifts rather than short-term market movements and give investors a way to align with changes likely to influence industries for years.

2. Why are megatrends performing strongly in 2025? In 2025, many high-growth themes beyond the large US tech names have gained momentum. Areas such as nuclear energy, defence, rare earth miners, quantum computing, and renewable energy have benefited from rising demand, policy support, and renewed interest in innovation.

3. How has the WisdomTree Megatrends UCITS ETF performed? Since launching in October 2023, the strategy has outperformed both the Nasdaq 100 and MSCI All Country World Index, despite having only a small allocation to the “Magnificent 7” tech stocks. This highlights the strength of looking beyond mega-cap technology when seeking long-term growth.

4. What makes the WisdomTree Megatrends strategy different? It uses a three-layered process: identifying long-term themes with strong potential, tilting towards themes showing strength through quarterly adjustments, selecting companies closely aligned with each trend using specialist research. This structured approach aims to stay adaptive while keeping the portfolio focused.

5. Why does the ETF invest relatively little in mega-cap tech? The strategy looks beyond today’s biggest names to capture the next generation of growth themes. Rather than concentrating on a handful of dominant companies, it spreads investment across emerging areas such as AI infrastructure, clean energy, and strategic materials.

6. How often does the Megatrends portfolio change? The portfolio is reviewed and adjusted every three months. This helps it stay aligned with the strongest-performing themes, increasing exposure where momentum is positive and reducing areas that are lagging.

7. Which themes are currently strongest in the strategy? Recent performance has been supported by renewable energy, rare earth and strategic metals, China technology, and blockchain. 14 out of 18 themes contributed positively after the last rebalance, showing diversified performance drivers rather than reliance on a single sector.

8. Is a Megatrends ETF suitable as a core investment? The strategy is not designed to be a core portfolio on its own. It is intended as an additional way to gain exposure to long-term structural trends, complementing a well-diversified core portfolio such as a broad global equity or balanced ETF mix.

9. How does the ETF decide how much to invest in each theme? Weights are adjusted using a tactical signal, which increases exposure (overweight) to themes showing relative strength and reduces exposure (underweight) where performance is weaker. This helps the portfolio adapt to changing markets while staying aligned with long-term themes.

10. What should investors consider before investing in thematic ETFs? Thematic investing focuses on long-term trends, but individual themes can be volatile, and returns may vary over time. Investors should check how a thematic allocation fits with their goals, risk appetite, and wider portfolio. Investments can go down as well as up, and you may get back less than you invest.

This content is part of a sponsored partnership with WisdomTree.

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt you may wish to consult a professional adviser for guidance.

Tax treatment depends on personal circumstances and is subject to change, and past performance is not a reliable indicator of future returns.

Please click here for WisdomTree’s full disclaimer.

Important information

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

This marketing communication has been prepared for professional investors, but the WisdomTree products set out in this document may be available in some jurisdictions to any investors, subject to applicable laws and regulations. As the product may not be authorised or its offering may be restricted in your jurisdiction, it is the responsibility of every person or entity to satisfy themselves as to the full observance of the laws and regulations of the relevant jurisdiction. Prior to any application investors are advised to take all necessary legal, regulatory, tax and investment advice on the suitability and consequences of an investment in the products. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares (“Shares”) representing each fund.

The Fund is described in a Key Information Document (KID) or Key Investor Information Document (KIID) for UK investors, and the prospectus of WT Issuer (“WT Prospectus”). A copy of the WT Prospectus and the KID / KIID is available, for EEA/UK only, in English at www.wisdomtree.eu. Where required under national rules, the KID will also be available in the local language of the relevant EEA Member State. Investors should read the WT Prospectus before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

The summary of investor rights associated with an investment in the fund is available in English on WisdomTree Europe’s website. WisdomTree Management Limited may decide to terminate the arrangements made for the marketing of its collective investment undertakings. In such circumstances, shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the fund free of any charges or deductions for at least 30 working days from the date of such notification.