Welcome to the latest edition of our monthly market roundups. Inflation and interest rates have dominated the conversation around markets so far this year, and it’s a similar story for the month of May.

Weaker commodity prices have contributed to a further decline in headline inflation numbers, however core inflation remains stubbornly high, particularly in the eurozone and the US.

Overall, the global economy represents something of a mixed bag, with the disparity between the service and manufacturing sectors widening in May.

The Purchasing Managers’ Index for US services rose to a 13-month high, while both the UK and Eurozone remained above the 55 level. Anything above 50 usually indicates economic expansion. This momentum is being supported by robust labour markets, with unemployment remaining at or near historical lows.

In contrast, the manufacturing sector’s PMI was down in the eurozone, falling to its lowest level in three years. Both the UK and US were below the 50 mark, which signals a contraction in activity.

For this month’s market update, we’ll take a look at the situations in the UK, the US and the eurozone, before taking a look at the performance of some of the key asset classes.

Inflation remains high in the UK

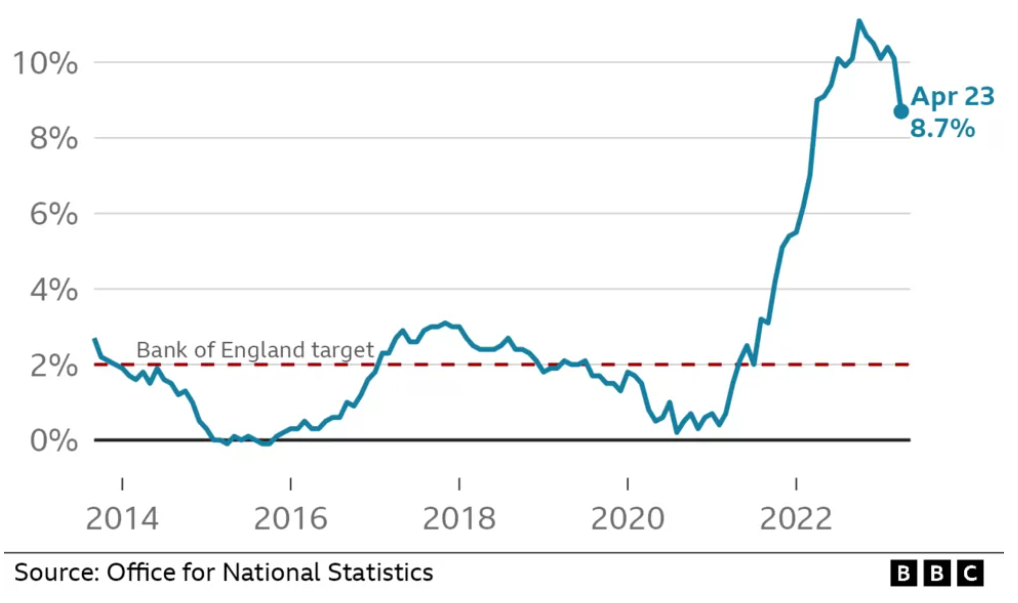

The Bank of England continued to wrestle with inflation in May by increasing interest rates to 4.5%. Despite the year-on-year CPI falling to 8.7%, this was still above expectations and the news was not well received by investors. Sticky inflation is driving the cost of living crisis, as wage growth is struggling to keep pace with inflation in real terms.

This translated into a poor performance for the FTSE 100, registering -4.93% for the month of May. This negative return was largely dictated by weaker commodity prices.

As a result, bond yields were pushed higher and UK Gilts ended the month as the worst performer in sovereign bonds.

Finally, further interest rate hikes are expected across the rest of 2023, however it’s likely they’ll become slightly less aggressive going forward.

The US raises its debt ceiling

Over in the US, the increase in the debt ceiling dominated the financial headlines in May, with President Joe Biden successfully signing the deal into law. Markets remained resilient, thanks in part to the probability of the debt ceiling being raised.

Year-on-year inflation fell to 4.9% in April, beating market forecasts. Food prices in particular grew at a slower rate than expected, while lower energy costs also contributed to the slower price growth.

As the Fed’s tightening of monetary policy continues to take effect, the central bank raised interest rates further by 25 bps to 5.25% at the beginning of May. There is an expectation that the Fed could pause its program of interest rate hikes for now.

Eurozone inflation proves stubborn

Eurozone inflation increased marginally in April to 7% year-on-year. This was largely caused by an increase in energy price inflation, an effect which is expected to be reversed when the May numbers are released. Core inflation continued its decline, as the rise in service inflation was offset by a decline in the price of core goods.

As expected, the European Central Bank increased rates to 3.75%, citing that past rate hikes into tighter monetary policy and financing conditions justified a change to a slower pace of hikes going forward.

Another mixed bag for equity markets

May represented another mixed month for equity markets. As we’ve discussed, the FTSE 100 finished the month down by -4.93%, but remained in the black for the year (up 0.43%).

The US continues to be the best-performing developed region this year, with the S&P 500 rising a further 1.96%, bringing the year-to-date gains to 6.34%. For the MSCI All Countries World, we saw a rise of 0.43%, with year-to-date gains of 4.57%.

Fixed income begins to level out

As a number of central banks start signalling a slowdown in interest rate rises, bond yields have begun to cater for rates near or at the terminal rate for the immediate future.

This didn’t stop some yields from increasing in May. The UK’s 10-year gilt, for example, finished at 4.18% (up from 3.72%) and the US 10-year treasury closed higher at 3.64% (up from 3.42%).

A mixed month for the pound

The pound sterling weakened against the US Dollar, with the currency losing -0.74% and finishing the month at $1.2441.

Versus the Euro, sterling fared much better, strengthening by 2.13% and finishing the month at €1.1564, a rate not seen since December 2022.

Important information

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt you may wish to consult a professional adviser for guidance.

Tax treatment depends on personal circumstances and is subject to change, and past performance is not a reliable indicator of future returns.