Our latest market roundup focuses on April. As has been the theme so far in 2023, inflation and interest rates were the headline numbers, with stubborn inflation forcing Central Banks to reconsider their rates. We’ll also take a look at the equity and bond markets, along with a few stories from the world of business.

Inflation remains stubborn

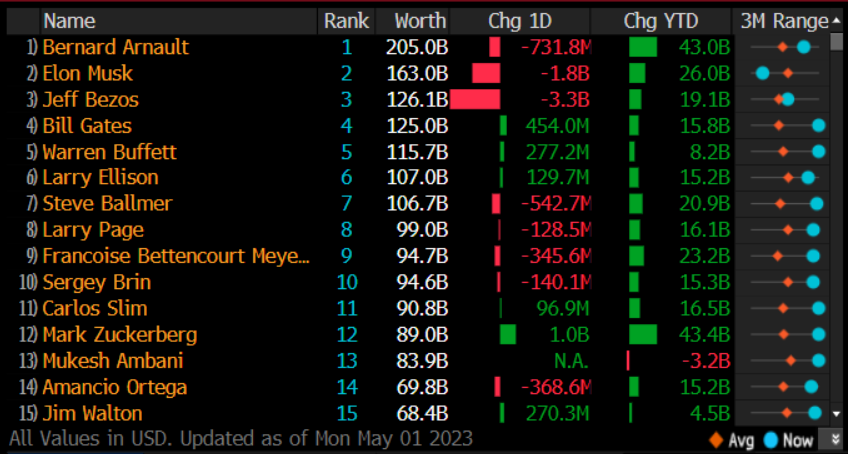

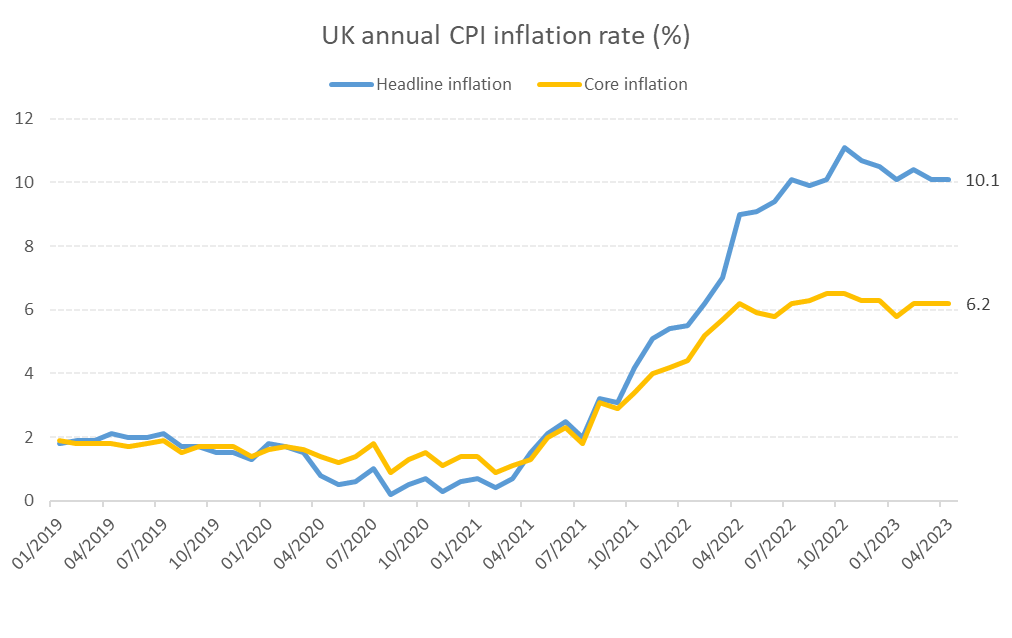

UK inflation showed no sign of easing after CPI figures were released in April, with prices rising 10.1% year-on-year. This was down from a 10.4% increase in the previous month, but was still higher than the market expected. The unexpectedly high inflation makes it more likely that the Bank of England will raise interest rates at their next meeting on 11th May.

“Core inflation” (which strips out the more volatile elements of the headline inflation figure, including energy and food) remains stubbornly high, rising by 6.2%. Core inflation has maintained a stable range of 5.8%-6.5% growth since this time last year, and has not yet begun to reverse course in line with broader inflation. This will likely raise concerns with policy makers that inflation is becoming more entrenched, and further bolster support for rate hikes.

In the US, headline inflation eased to its lowest level in nearly two years. US CPI rose by 5%, marking a significant deceleration from the 6% level recorded the previous month. Similarly to the UK, however, core CPI remained stickier than expected, rising by 5.6% year-on-year, an increase from 5.5% last month. This uptick will keep pressure on the Federal Reserve to raise rates again in May.

Interest rates could rise again

In response to rising core inflation figures, and absent any further material fallout from the US banking crisis, both the Bank of England and the Federal Reserve will be under pressure to raise interest rates in May.

Looking at overnight index swaps, the market is predicting a 100% chance of a further 0.25% rate hike from the BoE on the 11th May, taking the target rate from 4.25% to 4.50%. Longer-term, rates are priced to peak at around 4.9% in September, before starting to fall in the final quarter of the year.

In the US, the market is equally confident in a further hike, pricing in a 96% chance the Fed raises by 0.25% at the next meeting. In contrast to the UK, rates are priced to stay roughly at the 5% level over the coming months, before falling from September.

Equity Markets

Equity markets finished the month in the green, furthering the year-to-date gains. The UK market rose by 1.58%, bringing the total gains for the year to 4.33%, and in the US the S&P 500 rose by 1.15%, bringing the total gains for the year to 9.57%.

Emerging markets continue to lag behind developed markets, falling 1.05% for the month, despite remaining in the green for the year at +2.84%.

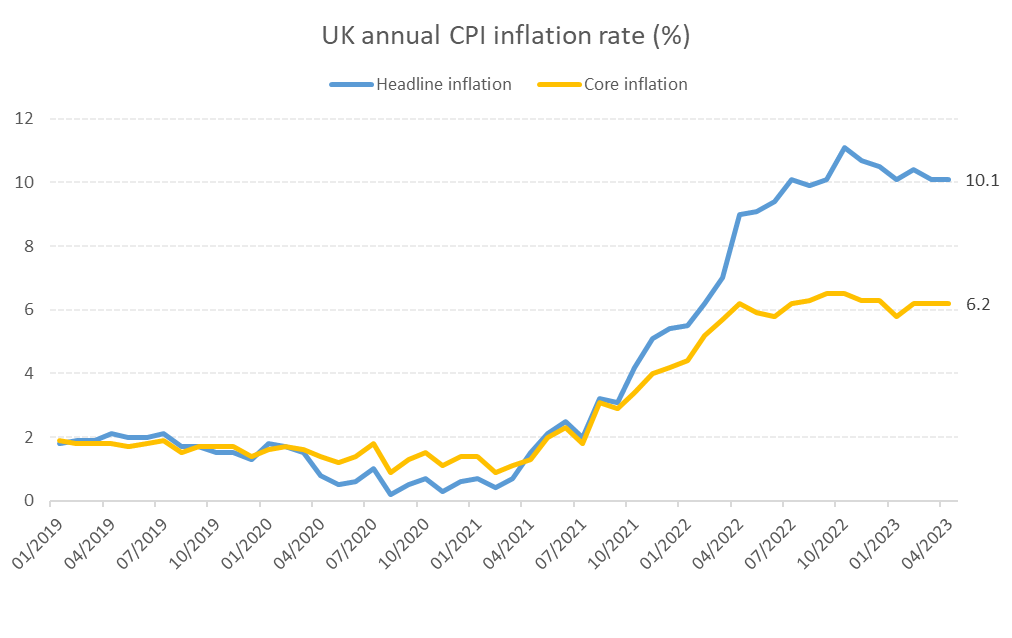

Bond yields

Following the raised expectations for further rate hikes caused by sticky inflation, bond yields rose over the month, with the UK 2-year gilt yield rising from 3.5% to 3.8%, and the UK 10-year gilt yield also rising from 3.5% to 3.7%:

Currencies

Versus the US dollar, sterling strengthened by 1.8% in April, rising from a rate of $1.2340 at the start of the month, and finishing at a rate of $1.2567. Sterling’s rise over April was due to signs of resilience in the UK economy bolstering investor expectations of further rises in interest rates, combined with softer than expected economic data in the US, which caused the dollar to weaken against most major currencies.

Versus the Euro, the pound also strengthened slightly over April, rising from a rate of €1.1359 to €1.1404.

Off the beaten track

Some of the less well covered market news stories in April.

Chunks of Apple

- 87% of US teens own an iPhone, and 88% expect an iPhone to be their next phone according to the 45th Semi-Annual Taking Stock With Teens® Survey, Spring 2023.

- Apple announced in its recent quarterly earnings that the company’s personal computer shipments tumbled over 40% in Q1 of this year, the worst decline since the dot-com crash. The drop was caused by the demand surge driven by pandemic-era remote work evaporating, combined with the general slowdown in US consumer spending over the last year.

- Apple partnered with US investment bank Goldman Sachs to offer a new savings account, which pays interest at more than 10 times the national average rate. The account yields 4.15% a year, having first announced the product in October. This is well ahead of the average US savings account rate of 0.37%, according to data from the Federal Deposit Insurance Corporation. This account is available to US customers only.

- Apple assembled more than $7 billion of iPhones in India last fiscal year, tripling production in the world’s fastest-growing smartphone arena after accelerating a move beyond China.The US company now makes almost 7% of its iPhones in India, and is exploring ways to reduce its reliance on China as tensions between Washington and Beijing continue to escalate.

ESG is losing its glamour

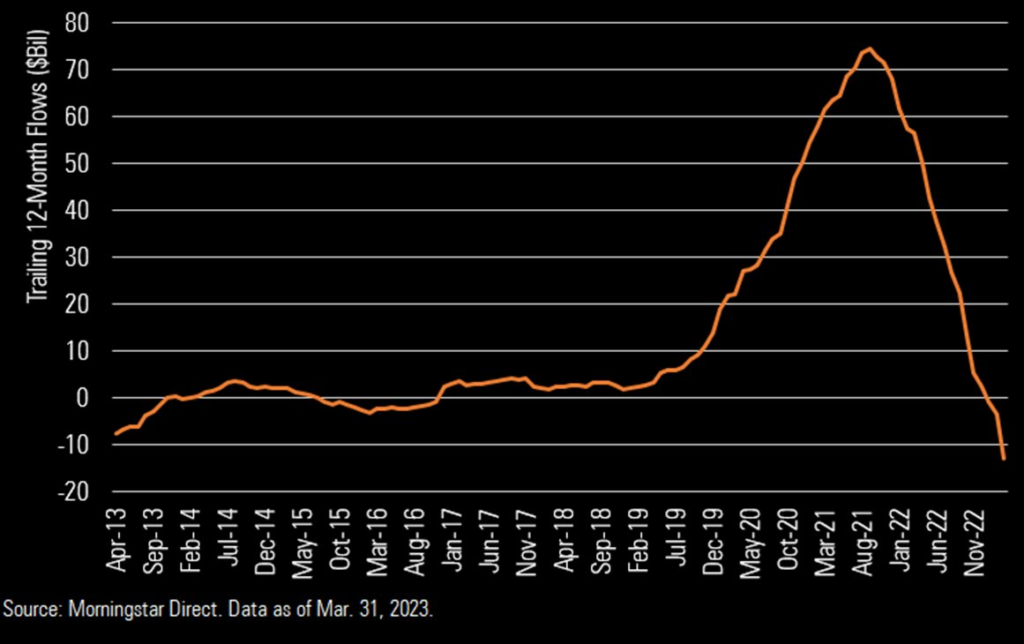

Data from Morningstar shows the trailing 12m flows into sustainable mutual funds and ETFs over the past decade:

Source: Morningstar Direct

…but ETFs are still picking up pace

“Flows into exchange traded funds almost trebled to $62.1bn last month, with the bulk heading into safe assets like government debt as investors sought shelter from the recent banking crisis. Developed market government bond ETFs soaked up a record $33.2bn of the money, eclipsing the previous monthly peak of $27.4bn set in May 2022, according to data from BlackRock.”

Source: The Financial Times

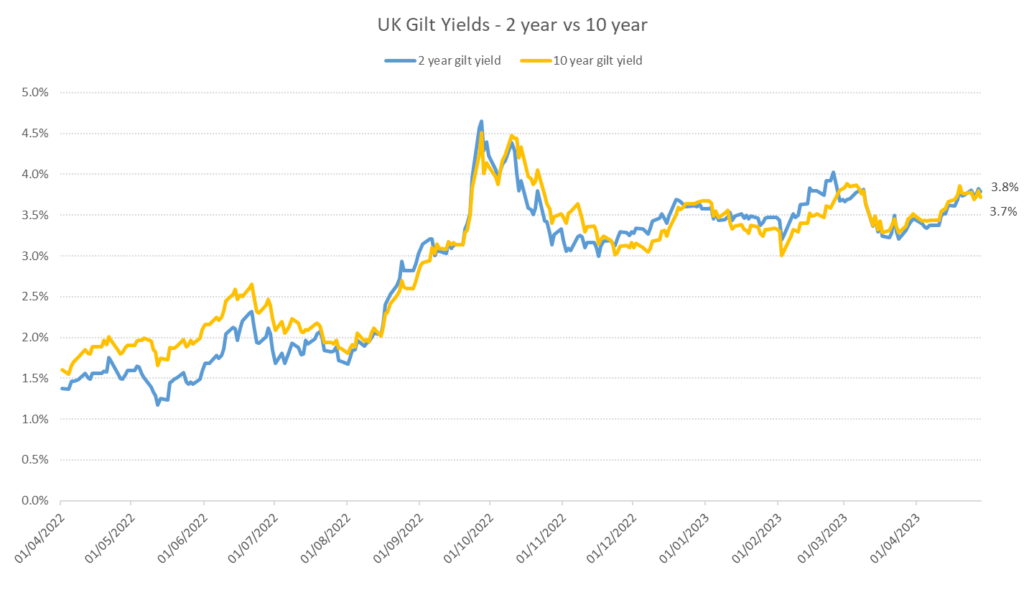

And there’s a new king in town

Bernard Arnault, the 74-year-old CEO of LVMH, is now the world’s richest man with an estimated net worth of over $200 billion – taking the title from Elon Musk. While the majority of Arnault’s wealth comes from his luxury goods empire, he has also established himself as a prominent investor, backing a variety of high-growth startups.

The full rich list, according to Bloomberg: