We all want to invest confidently. When it comes to our money, the feeling that we’re doing the right thing is important, and we all want to see our investments grow.

There is often a misconception, however, about exactly what confident investing means. It’s not backing the next tech giant from day one, it’s not putting everything you own into bitcoin and it’s not shouting the loudest on a trading floor.

For most people, confident investing means building a solid portfolio and ignoring a lot of the unhelpful noise that so often comes with financial news and content.

So, here are the key things that confident, long-term, sensible investors ignore.

Short-term noise

The most important thing for confident investors to ignore is short-term market ups and downs.

Volatility – the up and down fluctuations of investments – is an inevitable part of investing your money, so worrying about daily or weekly changes to your portfolio isn’t usually very helpful.

For the confident investor, a long-term outlook is always more useful. They think in terms of years or even decades, aiming for long-term growth over short term gain (or loss).

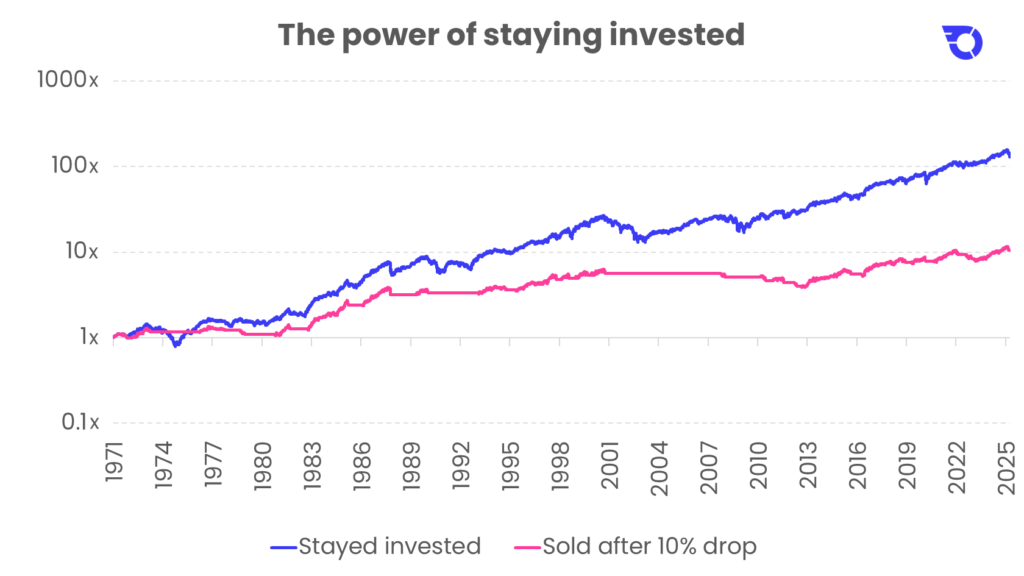

This isn’t just a mentality thing, either. Generally – or, historically – it pays to stay the course anyway. The chart below shows the difference that selling your investments during rocky periods can make.

Bloomberg, MSCI World in GBP since 1971, log scale. Assumes an investor sells after a 10% drop, earning zero returns, and reinvests when the market reaches a new high. Past performance is not indicative of future results.

So, historically, the confident investor – i.e. one that trusts in their portfolio and is able to see short term dips in their broader context – has been better off over the long-term.

You might have heard the phrase time in the market beats timing the market and it’s not just a cliche, there’s plenty of evidence to support the idea. As you can see, missing out on recovery periods as a result of selling can have a significant impact on a portfolio’s value over time.

The right entry & exit points

The confident investor takes a hands-off, long-term approach to their portfolios. As a result, the actual point at which they buy and sell their assets isn’t as important as it is for other types of investors.

Far too many investors get caught up on this decision. Am I buying at the right time? Will markets dip in the coming months? If you take a long-term diversified approach, these considerations are a lot less impactful.

Of course, no one wants to sell immediately after a market crash. Unless you’re particularly unlucky, however, the regular ups and downs of the market shouldn’t make too much of a difference at the end of a five or 10-year investment cycle.

Another method confident investors use is pound cost averaging – this is the process of investing little-and-often, which ultimately makes market timing unimportant.

By spreading out your entry point, the idea is that you end up buying at both the top and bottom of each market cycle. It’s not about timing the market, it’s about building your wealth over time, and drip feeding cash can take any potential stress out of the decision-making.

The latest investment fads

Part of taking a long-term approach to investing is avoiding the temptation of jumping on trends.

No one likes to miss out on the kind of spikes we see in assets like cryptocurrency, but for every success story there are an equal number of people who lost out by taking a punt at the wrong time. Unsurprisingly, however, the winners tend to be the louder voices.

These kinds of investment bets are antithetical to the confident investor’s ethos. When you have a solid portfolio with a long-term view, these kinds of quick wins (and losses) aren’t on your radar.

Don’t mistake loudness for confidence – truly confident long-term investors don’t pay attention to anyone selling them the dream. They know that sustainable wealth building takes time, not a crystal ball.

What they never ignore

There are a few things that confident investors can never ignore. These are:

- Fees. High fees can seriously eat into investment returns. This problem only compounds over the long-term. So, real investing confidence comes from knowing you’re not overpaying for your portfolios.

InvestEngine doesn’t charge fees on DIY portfolios. That means no trading fees, no yearly fees, no withdrawal fees – you only pay the small underlying ETF costs.

- Risk level. Your portfolio’s risk level does matter. Whether you’re investing for two years or 22, finding the balance between growth and risk is something every investor needs to get right.

- Diversification. Having your investments spread across a variety of regions, sectors and asset types can help you invest confidently. It means you don’t take on too much risk in any given area.

- Tax wrappers. The difference that tax treatments can make over the long-term is substantial. Using an ISA, for example, means any returns you make are yours, completely tax-free. There are restrictions to this, along with other options, so it’s worth doing your research before you open a portfolio.

When it comes to confident investing, our Head of Investments, Andrew Prosser, says:

“Confidence in investing comes from knowing you’re in a low-cost, diversified portfolio which suits your personal risk tolerance and goals. It grows as you learn more, particularly the value of ignoring short-term market noise, helping you stay focused on the long term.”

How to become a confident investor

Get started with your own investment portfolio and become a confident investor yourself. With just a handful of ETFs, you can invest globally, with your cash spread across industries, geographies and asset types.

How to build an investment portfolio using ETFs

Key factors for building a portfolio you can be confident in

- You can start investing with as little as £100.

- Fractional investing makes diversification easier than ever, even on a small budget.

- Keeping fees low means more money working for you.

- Effortless automation helps you stay on track with regular investing.

With InvestEngine, building a low-cost, globally diversified ETF portfolio is straightforward, accessible, and designed to grow with you.

Important information

Capital at risk. The value of your investments can go down as well as up, and you may get back less than you put in.

Tax treatment depends on individual circumstances and is subject to change. ETF costs also apply.

This content is for information only and is not financial advice. If in doubt you may wish to consult a professional adviser for guidance.