What were the most popular investments for Stocks and Shares ISAs in 2025?

In this article, we’ll explore why ISAs have had an interesting year, what the future looks like and the investments our customers are making in response.

A big year for ISAs

ISAs have been the subject of speculation for most of 2025. In Labour’s Autumn Budget, however, we got confirmation of some big changes coming down the line.

The reduction of the annual Cash ISA limit (for under 65s) from £20,000 to £12,000 is probably the biggest change for most investors. It means finding an alternative place to put that additional £8,000 if you want to maximise your tax efficiency.

The move is clearly designed to encourage investment. Stocks and Shares ISAs are one of the most tax-efficient ways to do that in the UK.

With lower-risk options that many will use as an alternative to cash, alongside more growth-focused investments, the Stocks and Shares ISA is flexible and can be an effective way to grow wealth for the long-term.

The most popular ISA ETFs in 2025

What are InvestEngine clients doing in light of the big news? We’ve taken a look at the most bought ETFs on the InvestEngine platform in 2025.

We’ll go into what this tells us about investor behaviour but, without further ado, here are the most popular Stocks and Shares ISA ETFs for 2025.

This list of ‘Top ETFs’ is based on the most held ETFs on InvestEngine’s platform. Top ETFs have been calculated by most bought (by number of clients) between January 2025 and December 2025.

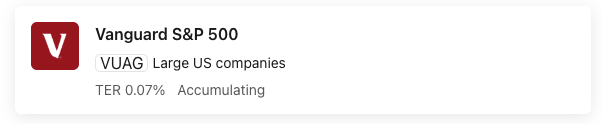

Vanguard S&P 500 (VUAG)

The number one spot goes to Vanguard’s leading S&P 500 option.

As an S&P 500 tracker, it aims to replicate the performance of the US’ biggest stock market. So, it gives investors exposure to the 500 biggest companies in the US.

Why it’s so popular

The US is home to some of the biggest and most famous companies on the planet. The likes of Apple, Microsoft, Google (Alphabet), Meta and more are all part of the US and are therefore included in this ETF.

Being the world’s largest economy by some distance, the US is at or near the top of almost all investor shopping lists when building a portfolio.

There’s no guarantee of returns and past performance can’t give you any indication of how it’ll do in the future, but the S&P 500’s popularity has, historically, been grounded in strong performance.

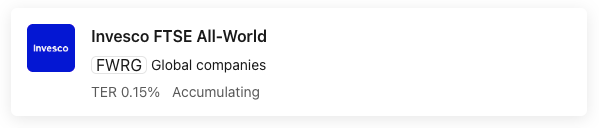

Invesco FTSE All-World (FWRG)

The runner up in 2025 is Invesco’s global All-World option.

As a FTSE All-World tracker, the ETF aims to replicate the performance of this truly global index. It contains medium and large sized companies from across both developed and emerging markets globally.

Why it’s so popular

All-World trackers are a one-stop shop for instant diversification. Want to invest but don’t want to put all your eggs in one country’s basket? Go global.

Some countries (like the US) make up a significant chunk of these ETFs, but it’s somewhat balanced out by companies from elsewhere around the world. These will capture the global stock market well enough for most investors – you won’t need to learn how to pick stocks or monitor market performance to stay on track.

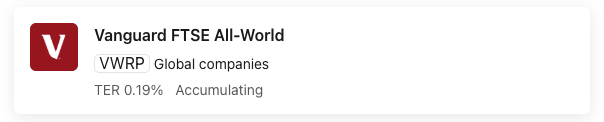

Vanguard FTSE All-World (VWRP)

Vanguard takes another podium spot here with their take on the FTSE All-World tracker.

Like the second-placed ETF, this aims to replicate the performance of the same global index. The exact investment weightings within these ETFs differ slightly, so it’s worth taking a closer look before making any decisions. The price is also different, so factor that into your decision-making.

Why it’s so popular

Like Invesco’s FTSE All-World option, this ETF is another one-stop shop solution for global diversification. Its TER of 0.19% (essentially its cost) is slightly higher than Invesco’s at 0.15%, but both are low.

Compared to Invesco’s, this Vanguard offering holds slightly less of a majority in the US, but the discrepancies are fairly small and you should take a closer look before choosing one over the other.

What does this tell us?

The top ETFs of 2025 can tell us a lot about investor sentiment.

Inflation has eased throughout the year and, with it, interest rates have fallen. Confidence also returned to global markets and investors moved back toward broad, diversified equity exposure.

Vanguard’s S&P 500 led the way. It benefitted from another strong year for US stocks, with tech and healthcare driving performance.

Global trackers like Invesco and Vanguard’s FTSE All World ETFs were also in demand, as investors went for a truly global approach.

Together, these ETFs highlight a balanced mindset in 2025: investors are combining global growth with diversification and a touch of defensiveness to prepare their portfolios for the year ahead.

How to buy ETFs easily with InvestEngine

InvestEngine makes it straightforward to invest in top ETFs, whether you’re building a long term portfolio or adding a few new funds for diversification.

Why use InvestEngine?

✅ No trading or platform fees

Buy and sell ETFs commission-free, so more of your money stays invested and working for you (ETF costs apply).

✅ Powerful portfolio tools

Track your holdings, compare ETFs, and rebalance whenever you need all in one simple dashboard.

✅ Automate your investing

Set up a Savings Plan to invest regularly, choosing how much and how often. It’s an easy way to stay consistent and build wealth over time.

✅ Flexible account options

Invest through an ISA, SIPP, general investment account, or Business account, all with no platform fees on DIY portfolios.

With these tools, InvestEngine makes it easy to own the ETFs that have led the market in 2025 and prepare your portfolio for the opportunities ahead in 2026.

Important information

Capital at risk. The value of your investments may go down as well as up, and you may get back less than you invest.

Remember, because ISA, pension and tax rules change, any benefits will depend on your personal circumstances. Scottish tax rules are also different.

ETF costs apply. If in doubt, you may wish to consult a professional adviser for guidance.

Tax treatment depends on your personal circumstances and may change in future. This article is for general information only and does not constitute financial advice.