Considering moving from mutual funds to ETFs? We’ve got you covered.

A lot of investment platforms, like Hargreaves Lansdown, offer mutual funds as a core of their portfolios. At InvestEngine, we prefer ETFs. The two are similar, but there are some key differences you should be aware of.

Here, we’ll go through these differences. We’ll also explain how replicating your portfolio with ETFs is easy and could benefit you long-term.

Why ETFs might be a good option

You can keep a similar exposure. A lot of investors are unhappy with their provider but happy with their portfolio. For most people, building an equivalent portfolio using ETFs is straightforward, so you won’t need to change things up.

Lower fees. ETFs generally come with lower fees than mutual funds. There are exceptions, but the average cost is lower. So, on top of cutting platform fees, you can pay less for your investments.

Getting started is free. InvestEngine doesn’t charge platform fees or trading fees for DIY portfolios. So, you can get your ETF portfolio set up completely free before you switch – you’ll only pay the underlying ETF costs when you invest.

What you can invest in

Like mutual funds, the choice of ETFs is endless. There are, however, some core types you might want to consider:

Global diversification: the “all-weather” option. Pick from globally diversified ETFs like the FTSE All-World UCITS ETF (FWRG), which spreads your money across thousands of companies in developed and emerging markets.

Regional focus: US and European market leaders. Focus on popular regions like the S&P 500 (US large caps) or the Nasdaq 100 (US tech giants) if you want a more targeted portfolio.

A lower risk approach: Overnight Rate ETFs. Use Overnight Rate ETFs to park cash in relatively low-risk, short-term instruments while still earning interest-like returns. (Capital at risk).

Some blend of these is usually suitable for most investors. You can find out more about the options here.

How to transfer from mutual funds to ETFs

Swapping your mutual funds out for ETFs is easy. Here’s how:

- Set up and log into your InvestEngine account

- On ‘My dashboard’, open your ISA portfolio (or create one) and you’ll see an option to transfer an existing ISA

- Confirm your details and the details of the ISA you want to transfer

- Sit back and relax

Any ETFs that you hold will be transferred in-specie, meaning they won’t need to be sold before moving.

The rest (like mutual funds) will be sold, and you can then buy equivalents from our range of ETFs.

Take a look at our range to see how easily you could replicate your portfolio.

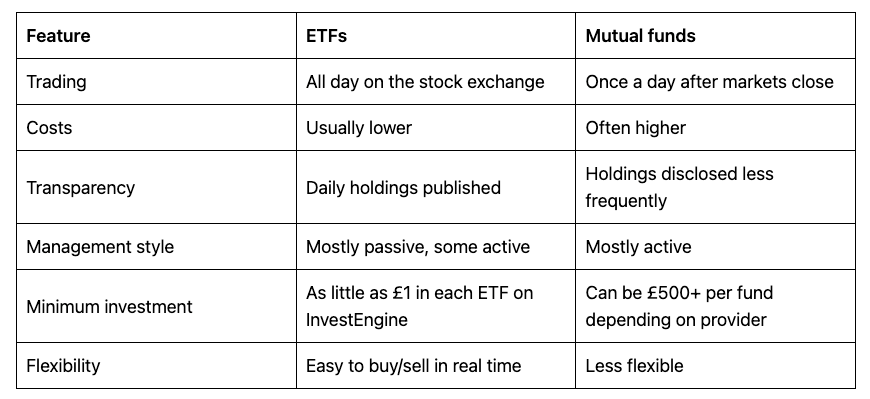

Key differences at a glance

Key differences in more detail

Here are the key differences between ETFs and mutual funds:

Fees

Generally speaking, actively managed mutual funds tend to come with higher fees and higher expense ratios than ETFs.

This is simply the cost of active management. ETFs do have fees of their own, but they are relatively minor and are a result of being bought and sold like stocks.

How they’re traded

One of the clearest points of difference between ETFs and mutual funds is how (and when) they are traded. Like stocks, ETFs can be traded intraday, meaning they can be bought and sold at any time if the market is open.

Mutual funds, on the other hand, are traded once per day and all investors trading on that day receive the same price. Arguably, this means that mutual funds are less flexible than ETFs.

Management

Another key difference is the degree to which each fund is managed. While they can be both actively and passively managed, most ETFs are passive investments – that is to say that they try to reflect the performance of a particular index.

Mutual funds are also both active and passive, but the majority are actively managed. This means that fund managers made active decisions about what to include in the funds. This is a distinction that has been blurred in recent years, so it’s worth investors checking before making any decisions.

Which is right for you?

Mutual funds may still appeal to investors who want a traditional, actively managed option.

For those looking for a low-cost, flexible, and transparent way to invest, however, ETFs are often the more efficient choice.

FAQs on ETFs vs mutual funds

1. What is an ETF and why are they popular in the UK? An exchange-traded fund (ETF) is an investment fund that trades on the stock exchange like a share. They’re popular in the UK because they offer low costs, tax efficiency, and easy access to a wide range of markets.

2. How many ETFs are available on the London Stock Exchange? The London Stock Exchange lists over 2,300 ETFs, covering asset classes from global equities and bonds to commodities and thematic investments.

3. Why are ETFs considered a cost-effective investment option? Most ETFs track an index using transparent, rules-based methods. This keeps costs lower than actively managed funds.

4. Can UK investors hold ETFs inside an ISA or SIPP? Yes. ETFs can be held in ISAs and SIPPs, both of which are held on InvestEngine, allowing you to invest tax‑efficiently.

5. What makes ETFs more transparent than other funds? ETF providers publish their full list of holdings every day. This gives investors visibility over exactly what they own, helping to avoid duplication across portfolios.

6. How liquid are ETFs compared to other investments? ETFs can be bought and sold during market hours, just like company shares. On InvestEngine, we trade once a day, keeping our (and yours) costs low. ETFs liquidity depends on the underlying assets but, with tight spreads, they’re often more accessible than traditional funds.

7. Are there tax advantages when buying ETFs in the UK? When you hold them inside ISAs and SIPPs, they are tax-efficient.

8. Can ETFs give exposure to specific themes or markets? Absolutely. From AI and clean energy to UK bonds and global equities, ETFs let investors build portfolios that reflect both broad market exposure and targeted themes.

9. How do ETFs support diversification for UK investors? Each ETF can hold hundreds or even thousands of securities, spreading risk across companies, countries, and sectors. This makes them ideal building blocks for diversified portfolios.

10. How do I start investing in ETFs with InvestEngine? You can open an InvestEngine account, choose your ETFs, and start investing commission-free (ETF costs apply). Our platform offers DIY portfolios, which can suit different goals.

Important information

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt, you may wish to consult a professional adviser.

Tax treatment depends on personal circumstances and is subject to change. Past performance is not a reliable indicator of future returns.