With just a few weeks until Christmas, the festive season is well and truly upon us. For some people, this means annual bonuses may be on the way.

It’s worth saying that a bonus is something to be enjoyed. It does, however, make (boring) sense to put at least some of it towards your financial future.

Whether it’s paying off any expensive debt, putting more into your pension or investing for the future, there are some smart financial moves you can make to give that bonus a life beyond Christmas.

So, if you’re lucky enough to get an annual bonus, or you’ve just gotten a promotion and want to do something with the extra cash, here are our suggestions.

Clear outstanding debts

Probably the most impactful financial decisions you can make is to pay off any expensive debt weighing you down.

Outside of a mortgage, the most common form of debt comes from credit cards. They’re useful, but they can be a drain on your monthly finances if they’re not paid off quickly.

According to Finder, the average APR on a credit card in the UK is currently 36.3% Rates vary, but this kind of rate is eye-watering and can cost you a lot of money over the long run.

Before you splash the cash or invest lump sums into the markets, it’s always a good idea to see where you could cut expensive debt out of your life. So, check your credit cards and your monthly outgoings; you might be surprised when you see how much you’re paying.

Bonus: While we’re here, it’s also worth making sure you’re not paying too much in fees with your existing investment provider. These can really add up over the long run and can make a huge difference to your final pot. InvestEngine ISAs and SIPPs are both completely free from platform fees – this helps you keep more of what you make.

Power up your retirement pot

Let’s be honest, it’s not very exciting to put money away for retirement. But this doesn’t mean it’s not impactful.

It’s often a matter of perspective; retirement is, for many, a long way away, so it doesn’t feel like a financial priority. However, the earlier you make it one, the more time your investments have to (potentially) grow and compound.

Lump sums like annual bonuses can be ideal for this kind of long-term financial planning. The tax relief you get alone is powerful enough for it to be worthwhile for most people.

Almost everyone is entitled to 20% tax relief on contributions to a SIPP (a personal pension), with higher earners able to access as much as 45% in tax relief when they top up.

If you need a bit of inspiration, you can project your retirement finances using our handy pension calculator. You’ll be able to see what your retirement pot could look like after long-term investing.

Alternatively, you can see the impact of a lump sum like a bonus on a regular investment pot using our regular investing calculator. Mapping out the long-term impact can give you the push you might need to invest your cash.

Invest a lump sum

One of the best things you can do with a lump sum is to invest it. Of course, we would say that, but there is a strong argument that putting your cash to work can be beneficial in the long run.

It’s often said that an investor’s best asset is time. The longer you have to invest, the more you’re able to ride out ups and downs in the market and aim for that long-term growth we all want.

When you invest a lump sum, every penny is working for you from day one. You’re not guaranteed to make money right away but, if you do, more of your cash can contribute to that growth.

We’re going to explore pension contributions next. If you want to keep your cash accessible, however, investing in an ISA is probably the way to go.

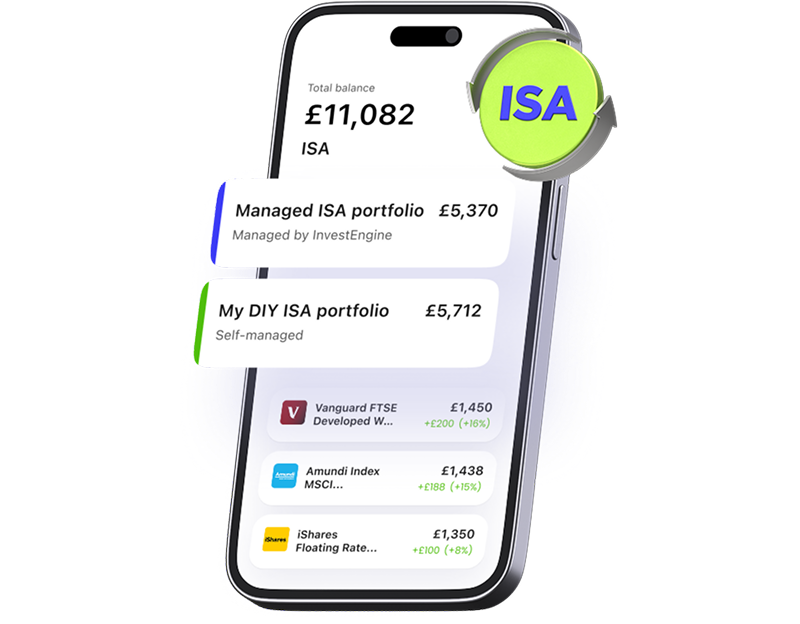

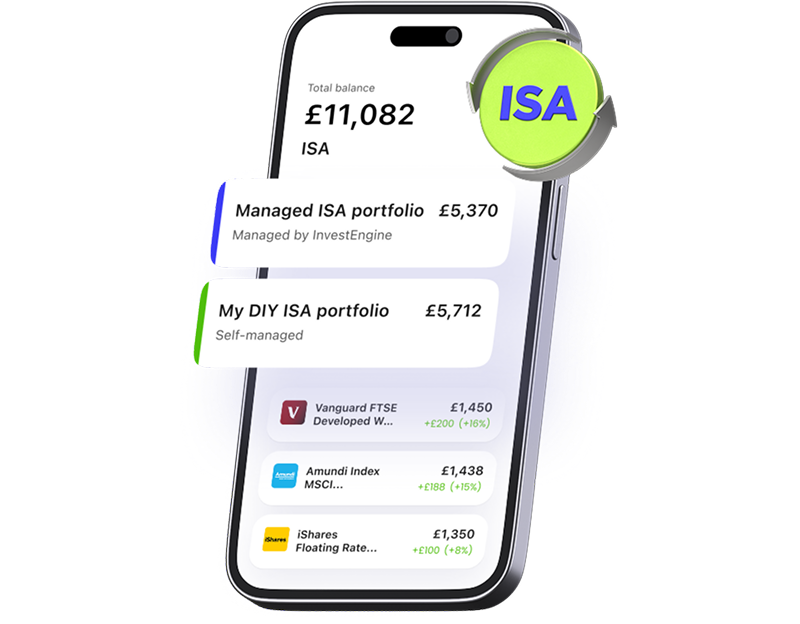

At InvestEngine, we’re all about Stocks and Shares ISAs as we believe they give your money the best chance to grow. So, if you want to explore investing a lump sum in markets with a range of options and tools to help you get started, check out an InvestEngine portfolio.

Transfer your ISA to InvestEngine

It’s easy to transfer your existing ISA to InvestEngine to take advantage of commission-free DIY investing. Coupled with our powerful tools, there’s never been a better time to switch.

Transfer my ISACapital at risk. Ts&Cs apply

Alternative: if you don’t want to invest your cash all at once, you could take advantage of ‘pound cost averaging’ by drip-feeding your bonus into markets over time. Here’s a quick guide on how that works.

Enjoy it

Being financially responsible is great. Spending money is also great. It’s important to be able to enjoy your financial successes and an annual bonus can absolutely be one of those.

It’s unrealistic to expect everyone to automatically contribute their entire annual bonus into their pension, however tax efficient that may be.

The conventional wisdom for most people’s income, for example, is that you would ideally spend 50% on needs, 30% on wants, and save or invest the other 20%. We’ll let you find your own 50/30/20 rule for annual bonuses, but a balance is always key.

Ultimately, we hope that people enjoy their bonuses but also consider how that cash could be used to position the person for better financial outcomes down the line. It’s why we do what we do at InvestEngine and we love making it easy to put money to work.

So, get started today if you’re not investing already. Otherwise, consider topping up one or both of your investment wrappers (ISA or SIPP) to make the most of any lump sum you’re fortunate enough to come into this winter period. Happy Investing.

Important information

Capital at risk. The value of your investments may go down as well as up, and you may get back less than you invest.

Remember, because ISA, pension and tax rules change, any benefits will depend on your personal circumstances. Scottish tax rules are also different.

ETF costs apply. If in doubt, you may wish to consult a professional adviser for guidance.

Tax treatment depends on your personal circumstances and may change in future. This article is for general information only and does not constitute financial advice.